深入理解 Uniswap v3 智能合约 - Core(一)

- adshao

- 发布于 2024-04-09 17:55

- 阅读 2473

此文详细介绍了 Uniswap v3 的智能合约,包括核心合约 UniswapV3Factory 和 UniswapV3Pool 的实现与功能,重点讲解了流动性管理、交易对创建、代币交换等操作的实现原理和代码示例,涵盖了预言机的使用及其扩展等技术细节,具有很强的实用性和参考价值。

深入理解 Uniswap v3 智能合约 (一)

概述

与Uniswap v2一样,Uniswap v3的合约也分为两类:

- Uniswap-v3-core

- Uniswap v3的核心代码,实现了协议定义的所有功能,外部合约可直接与core合约交互

- Uniswap-v3-periphery

- 基于使用场景封装接口,如头寸(Position)管理、多路径代币交换等功能,Uniswap界面即与periphery合约交互

如果你希望以用户场景角度阅读本文,请直接从Uniswap-v3-periphery开始,它包含了创建头寸、修改头寸流动性、交换代币等常用功能。

如果你希望从底层核心模块开始阅读,请从Uniswap-v3-core开始。

Uniswap-v3-core

UniswapV3Factory.sol

工厂合约主要包含三个功能:

- createPool:创建交易对池子

- setOwner:设置工厂合约Owner

- enableFeeAmount:添加手续费等级

createPool

创建一个Uniswap v3交易对池子,注意,由于Uniswap v3支持不同手续费等级,如0.05%、0.30%、1.00%等,因此一个交易对合约由tokenA、tokenB和fee(手续费)唯一确定。

计算交易对合约还需要:factory工厂合约地址、合约初始化代码的hash。

/// @inheritdoc IUniswapV3Factory

function createPool(

address tokenA,

address tokenB,

uint24 fee

) external override noDelegateCall returns (address pool) {

require(tokenA != tokenB);

(address token0, address token1) = tokenA < tokenB ? (tokenA, tokenB) : (tokenB, tokenA);

require(token0 != address(0));

int24 tickSpacing = feeAmountTickSpacing[fee];

require(tickSpacing != 0);

require(getPool[token0][token1][fee] == address(0));

pool = deploy(address(this), token0, token1, fee, tickSpacing);

getPool[token0][token1][fee] = pool;

// populate mapping in the reverse direction, deliberate choice to avoid the cost of comparing addresses

getPool[token1][token0][fee] = pool;

emit PoolCreated(token0, token1, fee, tickSpacing, pool);

}因为传入的tokenA和tokenB是无序的,首先对tokenA、tokenB排序,确保tokenA < tokenB。

通过手续费等级获取对应的tickSpacing:

int24 tickSpacing = feeAmountTickSpacing[fee];我们在《深入理解Uniswap v3白皮书》中介绍过tickSpacing的作用,每个手续费等级对应一个tickSpacing,只有被tickSpacing整除的tick才允许被初始化,tickSpacing越大,每个tick流动性越多,tick之间滑点越大,但会节省跨tick操作的gas。这里作为Pool的参数保存起来。

确认该交易对对应的手续费等级没有创建过:

require(getPool[token0][token1][fee] == address(0));创建(部署)交易对合约:

pool = deploy(address(this), token0, token1, fee, tickSpacing);deploy代码如下:

/// @dev Deploys a pool with the given parameters by transiently setting the parameters storage slot and then

/// clearing it after deploying the pool.

/// @param factory The contract address of the Uniswap V3 factory

/// @param token0 The first token of the pool by address sort order

/// @param token1 The second token of the pool by address sort order

/// @param fee The fee collected upon every swap in the pool, denominated in hundredths of a bip

/// @param tickSpacing The spacing between usable ticks

function deploy(

address factory,

address token0,

address token1,

uint24 fee,

int24 tickSpacing

) internal returns (address pool) {

parameters = Parameters({factory: factory, token0: token0, token1: token1, fee: fee, tickSpacing: tickSpacing});

pool = address(new UniswapV3Pool{salt: keccak256(abi.encode(token0, token1, fee))}());

delete parameters;

}我们在Uniswap v2中提到,为了确保交易对合约地址的可计算性和唯一性,Uniswap v2使用CREATE2操作码创建交易对合约;从Solidity 0.6.2版本开始(Github PR),支持在new方法中传递salt参数实现CREATE2功能;salt参数确保了合约地址的唯一性和可计算性。从代码可知,Uniswap v3交易对合约使用token0、token1、fee唯一确定一个交易对合约,比如,根据ETH-USDC 0.05%手续费(以及工厂合约地址、初始化代码hash)等信息,可计算交易对合约地址。

最后,保存交易对合约地址到getPool变量中:

getPool[token0][token1][fee] = pool;

// populate mapping in the reverse direction, deliberate choice to avoid the cost of comparing addresses

getPool[token1][token0][fee] = pool;setOwner

设置工厂合约owner,owner具有以下权限:

- setOwner:修改owner

- enableFeeAmount:添加手续费等级

- setFeeProtocol:修改某个交易对的协议手续费比例

- collectProtocol:收集某个交易对的协议手续费

首先判断请求由当前owner发起,确认后修改owner:

/// @inheritdoc IUniswapV3Factory

function setOwner(address _owner) external override {

require(msg.sender == owner);

emit OwnerChanged(owner, _owner);

owner = _owner;

}enableFeeAmount

Uniswap v3默认支持三种手续费等级:0.05%、0.30%和1.00%,对应的fee值分别为500、3000和10000;fee的基本单位是百分之一基点,即0.01 bp = $10^{-6}$。

手续费百分比计算公式为:

$$ f_{ratio} = \frac{fee}{1,000,000} $$

/// @inheritdoc IUniswapV3Factory

function enableFeeAmount(uint24 fee, int24 tickSpacing) public override {

require(msg.sender == owner);

require(fee < 1000000);

// tick spacing is capped at 16384 to prevent the situation where tickSpacing is so large that

// TickBitmap#nextInitializedTickWithinOneWord overflows int24 container from a valid tick

// 16384 ticks represents a >5x price change with ticks of 1 bips

require(tickSpacing > 0 && tickSpacing < 16384);

require(feeAmountTickSpacing[fee] == 0);

feeAmountTickSpacing[fee] = tickSpacing;

emit FeeAmountEnabled(fee, tickSpacing);

}UniswapV3Pool.sol

这是Uniswap v3的主要代码,定义了交易对池子的功能:

- initialize:初始化交易对

- mint:添加流动性

- burn:移除流动性

- swap:交换代币

- flash:闪电贷

- collect:取回代币

- increaseObservationCardinalityNext:扩展预言机空间

- observe:获取预言机数据

此外,factory(工厂合约)owner还可以调用以下两个方法:

- setFeeProtocol:修改某个交易对的协议手续费比例

- collectProtocol:收集某个交易对的协议手续费

initialize

创建完交易对后,需要调用initialize方法初始化合约,才能正常使用交易对功能。

该方法初始化slot0变量:

/// @inheritdoc IUniswapV3PoolActions

/// @dev not locked because it initializes unlocked

function initialize(uint160 sqrtPriceX96) external override {

require(slot0.sqrtPriceX96 == 0, 'AI');

int24 tick = TickMath.getTickAtSqrtRatio(sqrtPriceX96);

(uint16 cardinality, uint16 cardinalityNext) = observations.initialize(_blockTimestamp());

slot0 = Slot0({

sqrtPriceX96: sqrtPriceX96,

tick: tick,

observationIndex: 0,

observationCardinality: cardinality,

observationCardinalityNext: cardinalityNext,

feeProtocol: 0,

unlocked: true

});

emit Initialize(sqrtPriceX96, tick);

}slot0定义如下:

sqrtPriceX96:交易对当前的开根号价格 $\sqrt{P}$tick:当前 $\sqrt{P}$ 对应的tick,使用getTickAtSqrtRatio计算得出observationIndex:最近更新的(预言机)观测点数组序号observationCardinality:(预言机)观测点数组容量,最大65536,初始时为1observationCardinalityNext:下一个(预言机)观测点数组容量,如果手动扩容容量,会更新这个值,初始时为1feeProtocol:协议手续费比例,可以分别为token0和token1设置交易手续费中分给协议的比例unlocked:当前交易对合约是否非锁定状态

mint

该方法实现添加流动性功能。实际上,首次添加流动性和后续增加流动性,都会使用该方法。

mint方法参数如下:

recipient:头寸接收者(owner)tickLower:流动性区间低点tickUpper:流动性区间高点amount:流动性数量data:回调参数

/// @inheritdoc IUniswapV3PoolActions

/// @dev noDelegateCall is applied indirectly via _modifyPosition

function mint(

address recipient,

int24 tickLower,

int24 tickUpper,

uint128 amount,

bytes calldata data

) external override lock returns (uint256 amount0, uint256 amount1) {

require(amount > 0);

(, int256 amount0Int, int256 amount1Int) =

_modifyPosition(

ModifyPositionParams({

owner: recipient,

tickLower: tickLower,

tickUpper: tickUpper,

liquidityDelta: int256(amount).toInt128()

})

);

amount0 = uint256(amount0Int);

amount1 = uint256(amount1Int);

uint256 balance0Before;

uint256 balance1Before;

if (amount0 > 0) balance0Before = balance0();

if (amount1 > 0) balance1Before = balance1();

IUniswapV3MintCallback(msg.sender).uniswapV3MintCallback(amount0, amount1, data);

if (amount0 > 0) require(balance0Before.add(amount0) <= balance0(), 'M0');

if (amount1 > 0) require(balance1Before.add(amount1) <= balance1(), 'M1');

emit Mint(msg.sender, recipient, tickLower, tickUpper, amount, amount0, amount1);

}mint方法主要的逻辑都在_modifyPosition中,其返回的amount0Int和amount1Int表示:如果添加amount数量的流动性,则需要分别向交易对合约转入的token0和token1的代币数量。

调用方需在uniswapV3MintCallback完成代币的转入操作;调用mint方法的合约需要实现IUniswapV3MintCallback接口,Uniswap v3在periphery合约的NonfungiblePositionManager.sol实现该接口。

因为

mint调用方需要实现接口方法,因此个人ETH账户(EOA)无法调用该方法。

IUniswapV3MintCallback(msg.sender).uniswapV3MintCallback(amount0, amount1, data);_modifyPosition

继续来看_modifyPosition:

/// @dev Effect some changes to a position

/// @param params the position details and the change to the position's liquidity to effect

/// @return position a storage pointer referencing the position with the given owner and tick range

/// @return amount0 the amount of token0 owed to the pool, negative if the pool should pay the recipient

/// @return amount1 the amount of token1 owed to the pool, negative if the pool should pay the recipient

function _modifyPosition(ModifyPositionParams memory params)

private

noDelegateCall

returns (

Position.Info storage position,

int256 amount0,

int256 amount1

)

{

checkTicks(params.tickLower, params.tickUpper);

Slot0 memory _slot0 = slot0; // SLOAD for gas optimization

position = _updatePosition(

params.owner,

params.tickLower,

params.tickUpper,

params.liquidityDelta,

_slot0.tick

);先通过_updatePosition更新头寸信息,我们在下一节会具体介绍。

if (params.liquidityDelta != 0) {

if (_slot0.tick < params.tickLower) {

// current tick is below the passed range; liquidity can only become in range by crossing from left to

// right, when we'll need _more_ token0 (it's becoming more valuable) so user must provide it

amount0 = SqrtPriceMath.getAmount0Delta(

TickMath.getSqrtRatioAtTick(params.tickLower),

TickMath.getSqrtRatioAtTick(params.tickUpper),

params.liquidityDelta

);

} else if (_slot0.tick < params.tickUpper) {

// current tick is inside the passed range

uint128 liquidityBefore = liquidity; // SLOAD for gas optimization

// write an oracle entry

(slot0.observationIndex, slot0.observationCardinality) = observations.write(

_slot0.observationIndex,

_blockTimestamp(),

_slot0.tick,

liquidityBefore,

_slot0.observationCardinality,

_slot0.observationCardinalityNext

);

amount0 = SqrtPriceMath.getAmount0Delta(

_slot0.sqrtPriceX96,

TickMath.getSqrtRatioAtTick(params.tickUpper),

params.liquidityDelta

);

amount1 = SqrtPriceMath.getAmount1Delta(

TickMath.getSqrtRatioAtTick(params.tickLower),

_slot0.sqrtPriceX96,

params.liquidityDelta

);

liquidity = LiquidityMath.addDelta(liquidityBefore, params.liquidityDelta);

} else {

// current tick is above the passed range; liquidity can only become in range by crossing from right to

// left, when we'll need _more_ token1 (it's becoming more valuable) so user must provide it

amount1 = SqrtPriceMath.getAmount1Delta(

TickMath.getSqrtRatioAtTick(params.tickLower),

TickMath.getSqrtRatioAtTick(params.tickUpper),

params.liquidityDelta

);

}

}

}代码的下半部分则主要通过getAmount0Delta和getAmount1Delta计算该流动性需要分别提供的token0和token1的数量,即amount0和amount1。

具体地,当你提供流动性的区间大于当前tick $i_c$ 时,因为tick大小与 $\sqrt{P}$(即 $\sqrt{\frac{y}{x}}$ )成正比,意味着在大于 $i_c$ 的区间, $x$ 的价值更高(需要更少的 $x$ ),因此添加流动性时需在该部分提供 $x$ 代币,即amount0数量的token0;反之,则提供 $y$ 代币,即amount1的token1。

如下所示:

$$ \begin{cases}i_c, ..., \overbrace{i_l, ..., i_u}^{amount0} & \text{$i_c < i_l$}\ \overbrace{i_l, ...}^{amount1}, i_c, \overbrace{..., i_u}^{amount0} & \text{$i_l \leq i_c < i_u$}\ \overbrace{i_l, ..., i_u}^{amount1}, ..., i_c & \text{$i_u \leq i_c$}\end{cases} $$

其中, $i_l$ , $i_u$ 为提供流动性价格区间的边界, $i_c$ 为当前价格对应的tick。

如果当前价格在区间中,即 $i_l \leq i_c < i_u$ 时,_modifyPosition会记录一次(预言机)观测点数据,因为此时区间的流动性发生了变化,需要记录每流动性的持续时间secondsPerLiquidityCumulativeX128:

// write an oracle entry

(slot0.observationIndex, slot0.observationCardinality) = observations.write(

_slot0.observationIndex,

_blockTimestamp(),

_slot0.tick,

liquidityBefore,

_slot0.observationCardinality,

_slot0.observationCardinalityNext

);在计算amount0和amount1后,更新当前交易对的全局活跃流动性liquidity:

liquidity = LiquidityMath.addDelta(liquidityBefore, params.liquidityDelta);这个全局流动性会在swap时用到。

_updatePosition

_modifyPosition中的_updatePosition代码如下:

/// @dev Gets and updates a position with the given liquidity delta

/// @param owner the owner of the position

/// @param tickLower the lower tick of the position's tick range

/// @param tickUpper the upper tick of the position's tick range

/// @param tick the current tick, passed to avoid sloads

function _updatePosition(

address owner,

int24 tickLower,

int24 tickUpper,

int128 liquidityDelta,

int24 tick

) private returns (Position.Info storage position) {

position = positions.get(owner, tickLower, tickUpper);

uint256 _feeGrowthGlobal0X128 = feeGrowthGlobal0X128; // SLOAD for gas optimization

uint256 _feeGrowthGlobal1X128 = feeGrowthGlobal1X128; // SLOAD for gas optimization

// if we need to update the ticks, do it

bool flippedLower;

bool flippedUpper;

if (liquidityDelta != 0) {

uint32 time = _blockTimestamp();

(int56 tickCumulative, uint160 secondsPerLiquidityCumulativeX128) =

observations.observeSingle(

time,

0,

slot0.tick,

slot0.observationIndex,

liquidity,

slot0.observationCardinality

);observations.observeSingle计算从最后一次观测点到现在的累积ticktickCumulative和累积每份流动性的持续时间secondsPerLiquidityCumulativeX128。

flippedLower = ticks.update(

tickLower,

tick,

liquidityDelta,

_feeGrowthGlobal0X128,

_feeGrowthGlobal1X128,

secondsPerLiquidityCumulativeX128,

tickCumulative,

time,

false,

maxLiquidityPerTick

);

flippedUpper = ticks.update(

tickUpper,

tick,

liquidityDelta,

_feeGrowthGlobal0X128,

_feeGrowthGlobal1X128,

secondsPerLiquidityCumulativeX128,

tickCumulative,

time,

true,

maxLiquidityPerTick

);

if (flippedLower) {

tickBitmap.flipTick(tickLower, tickSpacing);

}

if (flippedUpper) {

tickBitmap.flipTick(tickUpper, tickSpacing);

}

}接着使用ticks.update分别更新tickLower(价格区间低点)和tickUpper(价格区间高点)的状态,具体请参考Tick.update。

如果对应tick的流动性从从0到有,或从有到0,则表示该tick需要被翻转。如果该tick未被标记为初始化,则标记为初始化;否则,将其取消初始化;这里用到tickBitmap.flipTick方法,请参考TickBitmap.flipTick。

(uint256 feeGrowthInside0X128, uint256 feeGrowthInside1X128) =

ticks.getFeeGrowthInside(tickLower, tickUpper, tick, _feeGrowthGlobal0X128, _feeGrowthGlobal1X128);接着,计算该价格区间的累积每流动性手续费。

position.update(liquidityDelta, feeGrowthInside0X128, feeGrowthInside1X128);更新头寸(Position)信息,这里主要更新了头寸的应收手续费tokensOwed0和tokensOwed1,以及头寸流动性liquidity,请参考Position.update。

// clear any tick data that is no longer needed

if (liquidityDelta < 0) {

if (flippedLower) {

ticks.clear(tickLower);

}

if (flippedUpper) {

ticks.clear(tickUpper);

}

}

}如果是移除流动性,并且tick被翻转,则调用clear清空tick状态。

最后,回到mint方法,调用者需要确保在uniswapV3MintCallback方法中,将这里计算出的amount0和amount1数量的token0和token1代币转入交易对合约。

总结mint方法的主要工作如下:

- 更新价格区间端点(lower, upper)的信息:

ticks.update - 如果Tick状态翻转,则更新位图的标识位,设置为“已初始化”或“未初始化”:

tickBitmap.flipTick - 更新头寸(Position)信息:

positions.update - 如果当前tick位于价格区间中,则:

- 写入一次预言机观测点:

observations.write - 更新全局活跃流动性:

liquidity

- 写入一次预言机观测点:

- 调用方向交易对合约转账:

uniswapV3MintCallback

burn

销毁流动性(burn)的逻辑与添加流动性(mint)几乎完全一样,唯一的区别是liquidityDelta是负的。

/// @inheritdoc IUniswapV3PoolActions

/// @dev noDelegateCall is applied indirectly via _modifyPosition

function burn(

int24 tickLower,

int24 tickUpper,

uint128 amount

) external override lock returns (uint256 amount0, uint256 amount1) {

(Position.Info storage position, int256 amount0Int, int256 amount1Int) =

_modifyPosition(

ModifyPositionParams({

owner: msg.sender,

tickLower: tickLower,

tickUpper: tickUpper,

liquidityDelta: -int256(amount).toInt128()

})

);

amount0 = uint256(-amount0Int);

amount1 = uint256(-amount1Int);

if (amount0 > 0 || amount1 > 0) {

(position.tokensOwed0, position.tokensOwed1) = (

position.tokensOwed0 + uint128(amount0),

position.tokensOwed1 + uint128(amount1)

);

}

emit Burn(msg.sender, tickLower, tickUpper, amount, amount0, amount1);

}这里与mint使用同一个_modifyPosition方法。

需注意,当销毁(部分)流动性后,代币并没有转回到调用方,而是以未领取代币的形式记在头寸(Position)上。

swap

swap方法是Uniswap v3代码的核心,该方法实现两个代币的交换,从token0交换到token1,或者相反。

相比Uniswap v2的同质化流动性,我们重点关注在swap过程中,价格如何变化,以及如何影响流动性的。

先来看swap方法的几个参数:

recipient:交易后的代币接收者zeroForOne:如果从token0交换token1则为true,从token1交换token0则为falseamountSpecified: 指定的代币数量,如果为正,表示希望输入的代币数量;如果为负,则表示希望输出的代币数量sqrtPriceLimitX96:能够承受的价格上限(或下限),格式为Q64.96;如果从token0到token1,则表示swap过程中的价格下限;如果从token1到token0,则表示价格上限;如果价格超过该值,则swap失败data:回调参数

/// @inheritdoc IUniswapV3PoolActions

function swap(

address recipient,

bool zeroForOne,

int256 amountSpecified,

uint160 sqrtPriceLimitX96,

bytes calldata data

) external override noDelegateCall returns (int256 amount0, int256 amount1) {

require(amountSpecified != 0, 'AS');

Slot0 memory slot0Start = slot0;

require(slot0Start.unlocked, 'LOK');

require(

zeroForOne

? sqrtPriceLimitX96 < slot0Start.sqrtPriceX96 && sqrtPriceLimitX96 > TickMath.MIN_SQRT_RATIO

: sqrtPriceLimitX96 > slot0Start.sqrtPriceX96 && sqrtPriceLimitX96 < TickMath.MAX_SQRT_RATIO,

'SPL'

);

slot0.unlocked = false;

SwapCache memory cache =

SwapCache({

liquidityStart: liquidity,

blockTimestamp: _blockTimestamp(),

feeProtocol: zeroForOne ? (slot0Start.feeProtocol % 16) : (slot0Start.feeProtocol >> 4),

secondsPerLiquidityCumulativeX128: 0,

tickCumulative: 0,

computedLatestObservation: false

});

bool exactInput = amountSpecified > 0;

SwapState memory state =

SwapState({

amountSpecifiedRemaining: amountSpecified,

amountCalculated: 0,

sqrtPriceX96: slot0Start.sqrtPriceX96,

tick: slot0Start.tick,

feeGrowthGlobalX128: zeroForOne ? feeGrowthGlobal0X128 : feeGrowthGlobal1X128,

protocolFee: 0,

liquidity: cache.liquidityStart

});上面代码主要是初始化状态相关的。

因为 $\sqrt{P} = \sqrt{\frac{y}{x}}$ ,当zeroForOne = true,即从token0到token1时,swap过程中 Pool 的 $x$ 变多, $y$ 变少,因此 $\sqrt{P}$ 逐渐减小,所以指定的价格极限sqrtPriceLimitX96需要小于当前市场价格sqrtPriceX96。

另外,需要注意几个关键数据:

- 初始交易价格

state.sqrtPriceX96为:slot0.sqrtPriceX96- 这里并没有使用

slot0.tick计算初始价格,因为计算出来的值与slot0.sqrtPriceX96可能不一致,我们在后面代码会看到,slot0.tick不能作为当前价格

- 这里并没有使用

- 初始可用流动性

state.liquidity为:liquidity,也就是我们在mint或burn时更新的全局可用流动性

根据zeroForOne和exactInput,可以有四种swap组合:

| zeroForOne | exactInput | swap |

|---|---|---|

| true | true | 输入固定数量token0,输出最大数量token1 |

| true | false | 输入最小数量token0,输出固定数量token1 |

| false | true | 输入固定数量token1,输出最大数量token0 |

| false | false | 输入最小数量token1,输出固定数量token0 |

一个完整的swap可以由多个step组成,代码如下:

// continue swapping as long as we haven't used the entire input/output and haven't reached the price limit

while (state.amountSpecifiedRemaining != 0 && state.sqrtPriceX96 != sqrtPriceLimitX96) {

StepComputations memory step;

step.sqrtPriceStartX96 = state.sqrtPriceX96;

(step.tickNext, step.initialized) = tickBitmap.nextInitializedTickWithinOneWord(

state.tick,

tickSpacing,

zeroForOne

);

// ensure that we do not overshoot the min/max tick, as the tick bitmap is not aware of these bounds

if (step.tickNext < TickMath.MIN_TICK) {

step.tickNext = TickMath.MIN_TICK;

} else if (step.tickNext > TickMath.MAX_TICK) {

step.tickNext = TickMath.MAX_TICK;

}

// get the price for the next tick

step.sqrtPriceNextX96 = TickMath.getSqrtRatioAtTick(step.tickNext);

// compute values to swap to the target tick, price limit, or point where input/output amount is exhausted

(state.sqrtPriceX96, step.amountIn, step.amountOut, step.feeAmount) = SwapMath.computeSwapStep(

state.sqrtPriceX96,

(zeroForOne ? step.sqrtPriceNextX96 < sqrtPriceLimitX96 : step.sqrtPriceNextX96 > sqrtPriceLimitX96)

? sqrtPriceLimitX96

: step.sqrtPriceNextX96,

state.liquidity,

state.amountSpecifiedRemaining,

fee

);

if (exactInput) {

state.amountSpecifiedRemaining -= (step.amountIn + step.feeAmount).toInt256();

state.amountCalculated = state.amountCalculated.sub(step.amountOut.toInt256());

} else {

state.amountSpecifiedRemaining += step.amountOut.toInt256();

state.amountCalculated = state.amountCalculated.add((step.amountIn + step.feeAmount).toInt256());

}

// if the protocol fee is on, calculate how much is owed, decrement feeAmount, and increment protocolFee

if (cache.feeProtocol > 0) {

uint256 delta = step.feeAmount / cache.feeProtocol;

step.feeAmount -= delta;

state.protocolFee += uint128(delta);

}

// update global fee tracker

if (state.liquidity > 0)

state.feeGrowthGlobalX128 += FullMath.mulDiv(step.feeAmount, FixedPoint128.Q128, state.liquidity);

// shift tick if we reached the next price

if (state.sqrtPriceX96 == step.sqrtPriceNextX96) {

// if the tick is initialized, run the tick transition

if (step.initialized) {

// check for the placeholder value, which we replace with the actual value the first time the swap

// crosses an initialized tick

if (!cache.computedLatestObservation) {

(cache.tickCumulative, cache.secondsPerLiquidityCumulativeX128) = observations.observeSingle(

cache.blockTimestamp,

0,

slot0Start.tick,

slot0Start.observationIndex,

cache.liquidityStart,

slot0Start.observationCardinality

);

cache.computedLatestObservation = true;

}

int128 liquidityNet =

ticks.cross(

step.tickNext,

(zeroForOne ? state.feeGrowthGlobalX128 : feeGrowthGlobal0X128),

(zeroForOne ? feeGrowthGlobal1X128 : state.feeGrowthGlobalX128),

cache.secondsPerLiquidityCumulativeX128,

cache.tickCumulative,

cache.blockTimestamp

);

// if we're moving leftward, we interpret liquidityNet as the opposite sign

// safe because liquidityNet cannot be type(int128).min

if (zeroForOne) liquidityNet = -liquidityNet;

state.liquidity = LiquidityMath.addDelta(state.liquidity, liquidityNet);

}

state.tick = zeroForOne ? step.tickNext - 1 : step.tickNext;

} else if (state.sqrtPriceX96 != step.sqrtPriceStartX96) {

// recompute unless we're on a lower tick boundary (i.e. already transitioned ticks), and haven't moved

state.tick = TickMath.getTickAtSqrtRatio(state.sqrtPriceX96);

}

}整理成伪代码(pseudo code)如下:

loop if 剩余代币 != 0 and 当前价格 != 最小(或最大)价格:

// step

初始价格 := 上一个step的价格

下一个tick := 根据当前tick,寻找最近的已初始化的tick,或者本组最后一个未初始化的tick

目标价格 := 根据下一个tick计算的价格

交换后的价格, 消耗的输入代币数量, 得到的输出代币数量, 交易手续费 := 完成一步交换(初始价格, 目标价格, 可用流动性, 剩余代币)

更新 剩余代币

更新 协议手续费

if 交换后价格 == 目标价格:

if tick已初始化:

价格穿越该tick,更新tick相关字段

更新 可用流动性

当前tick := 下一个tick - 1

else if 交换后价格 != 初始价格:

当前tick := 根据交换后价格计算tick首先需要根据当前tick寻找下一个tick,即tickNext,具体逻辑可参考:tickBitmap.nextInitializedTickWithinOneWord。

计算当前step的目标价格:

// get the price for the next tick

step.sqrtPriceNextX96 = TickMath.getSqrtRatioAtTick(step.tickNext);计算本次(step)交换的输入输出(即执行一次交换):

// compute values to swap to the target tick, price limit, or point where input/output amount is exhausted

(state.sqrtPriceX96, step.amountIn, step.amountOut, step.feeAmount) = SwapMath.computeSwapStep(

state.sqrtPriceX96,

(zeroForOne ? step.sqrtPriceNextX96 < sqrtPriceLimitX96 : step.sqrtPriceNextX96 > sqrtPriceLimitX96)

? sqrtPriceLimitX96

: step.sqrtPriceNextX96,

state.liquidity,

state.amountSpecifiedRemaining,

fee

);SwapMath.computeSwapStep将根据当前价格、目标价格、可用流动性、可用输入代币等数据,计算本次交换能最多成交的输入代币数量(amountIn),输出代币数量(amountOut),手续费(feeAmount)和成交后价格(sqrtRatioNextX96)。请参考computeSwapStep。

保存本次交易的amountIn和amountOut:

if (exactInput) {

state.amountSpecifiedRemaining -= (step.amountIn + step.feeAmount).toInt256();

state.amountCalculated = state.amountCalculated.sub(step.amountOut.toInt256());

} else {

state.amountSpecifiedRemaining += step.amountOut.toInt256();

state.amountCalculated = state.amountCalculated.add((step.amountIn + step.feeAmount).toInt256());

}- 如果是指定输入代币数量(

token0或token1)amountSpecifiedRemaining表示(扣除手续费后)剩余可用输入代币数量amountCalculated表示已输出代币数量(注意,这里是负值)

- 如果是指定输出代币数量(

token0或token1)amountSpecifiedRemaining表示剩余需要输出的代币数量(初始为负值,因此每次交换后需要+= step.amountOut),直到为0amountCalculated表示(加入手续费后)已使用的输入代币数量

计算协议手续费:

// if the protocol fee is on, calculate how much is owed, decrement feeAmount, and increment protocolFee

if (cache.feeProtocol > 0) {

uint256 delta = step.feeAmount / cache.feeProtocol;

step.feeAmount -= delta;

state.protocolFee += uint128(delta);

}如果开启了协议手续费,则从交易手续费中拆出协议手续费。注意,协议手续费的值feeProtocol表示交易手续费的 $\frac{1}{n}$。

// update global fee tracker

if (state.liquidity > 0)

state.feeGrowthGlobalX128 += FullMath.mulDiv(step.feeAmount, FixedPoint128.Q128, state.liquidity);计算(每流动性)全局累积手续费。

// shift tick if we reached the next price

if (state.sqrtPriceX96 == step.sqrtPriceNextX96) {

// if the tick is initialized, run the tick transition

if (step.initialized) {

// check for the placeholder value, which we replace with the actual value the first time the swap

// crosses an initialized tick

if (!cache.computedLatestObservation) {

(cache.tickCumulative, cache.secondsPerLiquidityCumulativeX128) = observations.observeSingle(

cache.blockTimestamp,

0,

slot0Start.tick,

slot0Start.observationIndex,

cache.liquidityStart,

slot0Start.observationCardinality

);

cache.computedLatestObservation = true;

}

int128 liquidityNet =

ticks.cross(

step.tickNext,

(zeroForOne ? state.feeGrowthGlobalX128 : feeGrowthGlobal0X128),

(zeroForOne ? feeGrowthGlobal1X128 : state.feeGrowthGlobalX128),

cache.secondsPerLiquidityCumulativeX128,

cache.tickCumulative,

cache.blockTimestamp

);

// if we're moving leftward, we interpret liquidityNet as the opposite sign

// safe because liquidityNet cannot be type(int128).min

if (zeroForOne) liquidityNet = -liquidityNet;

state.liquidity = LiquidityMath.addDelta(state.liquidity, liquidityNet);

}

state.tick = zeroForOne ? step.tickNext - 1 : step.tickNext;

} else if (state.sqrtPriceX96 != step.sqrtPriceStartX96) {

// recompute unless we're on a lower tick boundary (i.e. already transitioned ticks), and haven't moved

state.tick = TickMath.getTickAtSqrtRatio(state.sqrtPriceX96);

}- 如果本次交换后的价格达到目标价格(即根据寻找的下一个

tick计算的价格):- 如果该

tick已经初始化,则:- 通过

ticks.cross方法穿越该tick,反向设置相关Outside变量的数据 - 使用

tick净流动性liquidityNet更新可用流动性state.liquidity- 由于在mint初始化

tick时,tickLower的liquidityNet是正的,即liquidityDelta;tickUpper的liquidityNet是负的,即-liquidityDelta;因此这里需要根据zeroForOne的值来调整liquidityNet的正负 - 当

zeroForOne = true时,随着交易的进行, Pool 中 $x$ 变多, $y$ 变少,价格 $\sqrt{P}$ 逐渐变小,tick朝 lower 方向移动,如果穿越了tickLower,意味着离开区间,因此需要减少流动性;反之,如果穿越了tickUpper,意味着进入区间,因此需要增加流动性;即都使用-liquidityNet - 当

zeroForOne = false时,随着交易的进行, Pool 中 $y$ 变多, $x$ 变少,价格 $\sqrt{P}$ 逐渐变大,tick朝 upper 方向移动,如果穿越了tickUpper,意味着离开区间,因此需要减少流动性;反之,如果穿越了tickLower,意味着进入区间,因此需要增加流动性;即都使用liquidityNet

- 由于在mint初始化

- 通过

- 移动当前

tick到下一个tick

- 如果该

- 如果交换后的价格没有达到本次目标价格,但是又不等于初始价格,即表示此时交易结束:

- 使用交换后的价格计算最新的

tick值

- 使用交换后的价格计算最新的

重复上述step,直到交换完全结束。

完成交换后,更新全局状态:

// update tick and write an oracle entry if the tick change

if (state.tick != slot0Start.tick) {

(uint16 observationIndex, uint16 observationCardinality) =

observations.write(

slot0Start.observationIndex,

cache.blockTimestamp,

slot0Start.tick,

cache.liquidityStart,

slot0Start.observationCardinality,

slot0Start.observationCardinalityNext

);

(slot0.sqrtPriceX96, slot0.tick, slot0.observationIndex, slot0.observationCardinality) = (

state.sqrtPriceX96,

state.tick,

observationIndex,

observationCardinality

);

} else {

// otherwise just update the price

slot0.sqrtPriceX96 = state.sqrtPriceX96;

}- 如果交换后的

tick与交换前的tick不同:- 记录一次(预言机)观测点数据,因为

tickCumulative发生了改变 - 更新

slot0.sqrtPriceX96,slot0.tick等值,注意此时sqrtPriceX96与tick并不一定对应,sqrtPriceX96才能准确反映当前价格

- 记录一次(预言机)观测点数据,因为

- 如果交换前后

tick值相同,则只需要修改价格:- 更新

slot0.sqrtPriceX96

- 更新

同样,如果全局流动性发生改变,则更新liquidity:

// update liquidity if it changed

if (cache.liquidityStart != state.liquidity) liquidity = state.liquidity;更新累积手续费和协议手续费:

// update fee growth global and, if necessary, protocol fees

// overflow is acceptable, protocol has to withdraw before it hits type(uint128).max fees

if (zeroForOne) {

feeGrowthGlobal0X128 = state.feeGrowthGlobalX128;

if (state.protocolFee > 0) protocolFees.token0 += state.protocolFee;

} else {

feeGrowthGlobal1X128 = state.feeGrowthGlobalX128;

if (state.protocolFee > 0) protocolFees.token1 += state.protocolFee;

}注意,如果是从token0交换token1,则只能收取token0作为手续费;反之,只能收取token1作为手续费。

(amount0, amount1) = zeroForOne == exactInput

? (amountSpecified - state.amountSpecifiedRemaining, state.amountCalculated)

: (state.amountCalculated, amountSpecified - state.amountSpecifiedRemaining);计算本次交换需要的具体amount0和amount1。

// do the transfers and collect payment

if (zeroForOne) {

if (amount1 < 0) TransferHelper.safeTransfer(token1, recipient, uint256(-amount1));

uint256 balance0Before = balance0();

IUniswapV3SwapCallback(msg.sender).uniswapV3SwapCallback(amount0, amount1, data);

require(balance0Before.add(uint256(amount0)) <= balance0(), 'IIA');

} else {

if (amount0 < 0) TransferHelper.safeTransfer(token0, recipient, uint256(-amount0));

uint256 balance1Before = balance1();

IUniswapV3SwapCallback(msg.sender).uniswapV3SwapCallback(amount0, amount1, data);

require(balance1Before.add(uint256(amount1)) <= balance1(), 'IIA');

}

emit Swap(msg.sender, recipient, amount0, amount1, state.sqrtPriceX96, state.liquidity, state.tick);

slot0.unlocked = true;合约将输出代币转账给recipient,同时,调用方需要在uniswapV3SwapCallback方法将输入代币转给交易对合约:

至此,整个swap流程就结束了。

flash

本方法实现Uniswap v3闪电贷功能。

方法参数:

recipient:闪电贷接收者amount0:借出token0的数量amount1:借出token1的数量data:回调方法参数

/// @inheritdoc IUniswapV3PoolActions

function flash(

address recipient,

uint256 amount0,

uint256 amount1,

bytes calldata data

) external override lock noDelegateCall {

uint128 _liquidity = liquidity;

require(_liquidity > 0, 'L');

uint256 fee0 = FullMath.mulDivRoundingUp(amount0, fee, 1e6);

uint256 fee1 = FullMath.mulDivRoundingUp(amount1, fee, 1e6);闪电贷手续费与swap手续费相同,都是 $\frac{fee}{10^6}$。

uint256 balance0Before = balance0();

uint256 balance1Before = balance1();

if (amount0 > 0) TransferHelper.safeTransfer(token0, recipient, amount0);

if (amount1 > 0) TransferHelper.safeTransfer(token1, recipient, amount1);

IUniswapV3FlashCallback(msg.sender).uniswapV3FlashCallback(fee0, fee1, data);

uint256 balance0After = balance0();

uint256 balance1After = balance1();

require(balance0Before.add(fee0) <= balance0After, 'F0');

require(balance1Before.add(fee1) <= balance1After, 'F1');向收款人转入贷出的代币数量,flash方法的调用方需实现IUniswapV3FlashCallback.uniswapV3FlashCallback接口方法,并在该方法中归还代币,包含手续费。

// sub is safe because we know balanceAfter is gt balanceBefore by at least fee

uint256 paid0 = balance0After - balance0Before;

uint256 paid1 = balance1After - balance1Before;

if (paid0 > 0) {

uint8 feeProtocol0 = slot0.feeProtocol % 16;

uint256 fees0 = feeProtocol0 == 0 ? 0 : paid0 / feeProtocol0;

if (uint128(fees0) > 0) protocolFees.token0 += uint128(fees0);

feeGrowthGlobal0X128 += FullMath.mulDiv(paid0 - fees0, FixedPoint128.Q128, _liquidity);

}

if (paid1 > 0) {

uint8 feeProtocol1 = slot0.feeProtocol >> 4;

uint256 fees1 = feeProtocol1 == 0 ? 0 : paid1 / feeProtocol1;

if (uint128(fees1) > 0) protocolFees.token1 += uint128(fees1);

feeGrowthGlobal1X128 += FullMath.mulDiv(paid1 - fees1, FixedPoint128.Q128, _liquidity);

}

emit Flash(msg.sender, recipient, amount0, amount1, paid0, paid1);

}根据收取的手续费,计算协议手续费(注意,token0和token1的协议手续费是单独设置的,参考:setFeeProtocol),最后更新protocolFees和feeGrowthGlobal1X128。

collect

该方法实现取回代币功能,包括销毁流动性记录的代币和手续费代币。

参数如下:

recipient:代币接收者tickLower:头寸低点tickUpper:头寸高点amount0Requested:请求取回的token0数量amount1Requested:请求取回的token1数量

/// @inheritdoc IUniswapV3PoolActions

function collect(

address recipient,

int24 tickLower,

int24 tickUpper,

uint128 amount0Requested,

uint128 amount1Requested

) external override lock returns (uint128 amount0, uint128 amount1) {

// we don't need to checkTicks here, because invalid positions will never have non-zero tokensOwed{0,1}

Position.Info storage position = positions.get(msg.sender, tickLower, tickUpper);

amount0 = amount0Requested > position.tokensOwed0 ? position.tokensOwed0 : amount0Requested;

amount1 = amount1Requested > position.tokensOwed1 ? position.tokensOwed1 : amount1Requested;

if (amount0 > 0) {

position.tokensOwed0 -= amount0;

TransferHelper.safeTransfer(token0, recipient, amount0);

}

if (amount1 > 0) {

position.tokensOwed1 -= amount1;

TransferHelper.safeTransfer(token1, recipient, amount1);

}

emit Collect(msg.sender, recipient, tickLower, tickUpper, amount0, amount1);

}上述代码比较简单,这里不再展开。需要注意,如果希望取回所有代币,则需要指定比tokensOwned更大的数,比如可以使用type(uint128).max。

increaseObservationCardinalityNext

扩容预言机观测点的可写入空间,该方法调用Oracle.sol的grow方法实现扩容。

/// @inheritdoc IUniswapV3PoolActions

function increaseObservationCardinalityNext(uint16 observationCardinalityNext)

external

override

lock

noDelegateCall

{

uint16 observationCardinalityNextOld = slot0.observationCardinalityNext; // for the event

uint16 observationCardinalityNextNew =

observations.grow(observationCardinalityNextOld, observationCardinalityNext);

slot0.observationCardinalityNext = observationCardinalityNextNew;

if (observationCardinalityNextOld != observationCardinalityNextNew)

emit IncreaseObservationCardinalityNext(observationCardinalityNextOld, observationCardinalityNextNew);

}observe

批量获取指定时间的观测点数据,该方法调用Oracle.sol的observe实现。

/// @inheritdoc IUniswapV3PoolDerivedState

function observe(uint32[] calldata secondsAgos)

external

view

override

noDelegateCall

returns (int56[] memory tickCumulatives, uint160[] memory secondsPerLiquidityCumulativeX128s)

{

return

observations.observe(

_blockTimestamp(),

secondsAgos,

slot0.tick,

slot0.observationIndex,

liquidity,

slot0.observationCardinality

);

}setFeeProtocol

设置协议手续费的比例,该方法仅允许工厂合约的owner执行。

注意,需要分别设置token0和token1的协议手续费比例,该比例是交易手续费的占比,合法值为0(不开启协议手续费)或者 $4 \leq n \leq 10$,也就是可以设置协议手续费为交易手续费的 $\frac{1}{n}$。

/// @inheritdoc IUniswapV3PoolOwnerActions

function setFeeProtocol(uint8 feeProtocol0, uint8 feeProtocol1) external override lock onlyFactoryOwner {

require(

(feeProtocol0 == 0 || (feeProtocol0 >= 4 && feeProtocol0 <= 10)) &&

(feeProtocol1 == 0 || (feeProtocol1 >= 4 && feeProtocol1 <= 10))

);

uint8 feeProtocolOld = slot0.feeProtocol;

slot0.feeProtocol = feeProtocol0 + (feeProtocol1 << 4);

emit SetFeeProtocol(feeProtocolOld % 16, feeProtocolOld >> 4, feeProtocol0, feeProtocol1);

}slot0.feeProtocol类型为uint8,保存两种代币的协议手续费比例,高4位为token1,低4位为token0:

$$ slot0.feeProtocol = \overbrace{0000}^{fee1}\overbrace{0000}^{fee0} $$

因此,feeProtocolOld % 16表示token0的协议手续费比例fee0,feeProtocolOld >> 4表示token1的协议手续费比例fee1。

collectProtocol

取回协议手续费,该方法仅允许工厂合约的owner执行。

协议手续费有两个来源:

swap产生的交易手续费flash产生的闪电贷手续费

/// @inheritdoc IUniswapV3PoolOwnerActions

function collectProtocol(

address recipient,

uint128 amount0Requested,

uint128 amount1Requested

) external override lock onlyFactoryOwner returns (uint128 amount0, uint128 amount1) {

amount0 = amount0Requested > protocolFees.token0 ? protocolFees.token0 : amount0Requested;

amount1 = amount1Requested > protocolFees.token1 ? protocolFees.token1 : amount1Requested;

if (amount0 > 0) {

if (amount0 == protocolFees.token0) amount0--; // ensure that the slot is not cleared, for gas savings

protocolFees.token0 -= amount0;

TransferHelper.safeTransfer(token0, recipient, amount0);

}

if (amount1 > 0) {

if (amount1 == protocolFees.token1) amount1--; // ensure that the slot is not cleared, for gas savings

protocolFees.token1 -= amount1;

TransferHelper.safeTransfer(token1, recipient, amount1);

}

emit CollectProtocol(msg.sender, recipient, amount0, amount1);

}上述代码比较简单,此处不再展开。

Tick.sol

Tick.sol管理Tick内部状态。

tickSpacingToMaxLiquidityPerTick

根据tickSpacing计算每个tick最大流动性,只有能够被tickSpacing整除的tick才能够存放流动性:

/// @notice Derives max liquidity per tick from given tick spacing

/// @dev Executed within the pool constructor

/// @param tickSpacing The amount of required tick separation, realized in multiples of `tickSpacing`

/// e.g., a tickSpacing of 3 requires ticks to be initialized every 3rd tick i.e., ..., -6, -3, 0, 3, 6, ...

/// @return The max liquidity per tick

function tickSpacingToMaxLiquidityPerTick(int24 tickSpacing) internal pure returns (uint128) {

int24 minTick = (TickMath.MIN_TICK / tickSpacing) * tickSpacing;

int24 maxTick = (TickMath.MAX_TICK / tickSpacing) * tickSpacing;

uint24 numTicks = uint24((maxTick - minTick) / tickSpacing) + 1;

return type(uint128).max / numTicks;

}getFeeGrowthInside

计算两个tick区间内部的每流动性累积手续费,该方法实现白皮书公式6.17-6.19:

$$ f_a(i) = \begin{cases} f_g - f_o(i) & \text{$i_c \geq i$}\ f_o(i) & \text{$i_c < i$} \end{cases} \quad \text{(6.17)} $$

$$ f_b(i) = \begin{cases} f_o(i) & \text{$i_c \geq i$}\ f_g - f_o(i) & \text{$i_c < i$}\end{cases} \quad \text{(6.18)} $$

$$ f_r = f_g - f_b(i_l) - f_a(i_u) \quad \text{(6.19)} $$

代码如下:

/// @notice Retrieves fee growth data

/// @param self The mapping containing all tick information for initialized ticks

/// @param tickLower The lower tick boundary of the position

/// @param tickUpper The upper tick boundary of the position

/// @param tickCurrent The current tick

/// @param feeGrowthGlobal0X128 The all-time global fee growth, per unit of liquidity, in token0

/// @param feeGrowthGlobal1X128 The all-time global fee growth, per unit of liquidity, in token1

/// @return feeGrowthInside0X128 The all-time fee growth in token0, per unit of liquidity, inside the position's tick boundaries

/// @return feeGrowthInside1X128 The all-time fee growth in token1, per unit of liquidity, inside the position's tick boundaries

function getFeeGrowthInside(

mapping(int24 => Tick.Info) storage self,

int24 tickLower,

int24 tickUpper,

int24 tickCurrent,

uint256 feeGrowthGlobal0X128,

uint256 feeGrowthGlobal1X128

) internal view returns (uint256 feeGrowthInside0X128, uint256 feeGrowthInside1X128) {

Info storage lower = self[tickLower];

Info storage upper = self[tickUpper];

// calculate fee growth below

uint256 feeGrowthBelow0X128;

uint256 feeGrowthBelow1X128;

if (tickCurrent >= tickLower) {

feeGrowthBelow0X128 = lower.feeGrowthOutside0X128;

feeGrowthBelow1X128 = lower.feeGrowthOutside1X128;

} else {

feeGrowthBelow0X128 = feeGrowthGlobal0X128 - lower.feeGrowthOutside0X128;

feeGrowthBelow1X128 = feeGrowthGlobal1X128 - lower.feeGrowthOutside1X128;

}

// calculate fee growth above

uint256 feeGrowthAbove0X128;

uint256 feeGrowthAbove1X128;

if (tickCurrent < tickUpper) {

feeGrowthAbove0X128 = upper.feeGrowthOutside0X128;

feeGrowthAbove1X128 = upper.feeGrowthOutside1X128;

} else {

feeGrowthAbove0X128 = feeGrowthGlobal0X128 - upper.feeGrowthOutside0X128;

feeGrowthAbove1X128 = feeGrowthGlobal1X128 - upper.feeGrowthOutside1X128;

}

feeGrowthInside0X128 = feeGrowthGlobal0X128 - feeGrowthBelow0X128 - feeGrowthAbove0X128;

feeGrowthInside1X128 = feeGrowthGlobal1X128 - feeGrowthBelow1X128 - feeGrowthAbove1X128;

}首先根据当前tickCurrent,分别计算tickLower和tickUpper的 $f_a$ , $f_b$ ,最后计算出区间内手续费 $f_r$:

$$ \underbrace{\overbrace{..., i_l - 1}^{f_b(i_l)}, \overbrace{i_l, i_l + 1, ..., i_u - 1, i_u}^{f_r}, \overbrace{i_u + 1, ...}^{f_a(iu)}}{f_g} $$

为什么需要计算区间内每流动性累计手续费呢?因为每个头寸(Position)会在mint/burn时根据该值计算自己的应收手续费:

$$ liquidityDelta \cdot (feeGrowthInside - feeGrowthInsideLast) $$

update

更新tick状态,并返回该tick是否翻转flipped:

/// @notice Updates a tick and returns true if the tick was flipped from initialized to uninitialized, or vice versa

/// @param self The mapping containing all tick information for initialized ticks

/// @param tick The tick that will be updated

/// @param tickCurrent The current tick

/// @param liquidityDelta A new amount of liquidity to be added (subtracted) when tick is crossed from left to right (right to left)

/// @param feeGrowthGlobal0X128 The all-time global fee growth, per unit of liquidity, in token0

/// @param feeGrowthGlobal1X128 The all-time global fee growth, per unit of liquidity, in token1

/// @param secondsPerLiquidityCumulativeX128 The all-time seconds per max(1, liquidity) of the pool

/// @param tickCumulative The tick * time elapsed since the pool was first initialized

/// @param time The current block timestamp cast to a uint32

/// @param upper true for updating a position's upper tick, or false for updating a position's lower tick

/// @param maxLiquidity The maximum liquidity allocation for a single tick

/// @return flipped Whether the tick was flipped from initialized to uninitialized, or vice versa

function update(

mapping(int24 => Tick.Info) storage self,

int24 tick,

int24 tickCurrent,

int128 liquidityDelta,

uint256 feeGrowthGlobal0X128,

uint256 feeGrowthGlobal1X128,

uint160 secondsPerLiquidityCumulativeX128,

int56 tickCumulative,

uint32 time,

bool upper,

uint128 maxLiquidity

) internal returns (bool flipped) {

Tick.Info storage info = self[tick];

uint128 liquidityGrossBefore = info.liquidityGross;

uint128 liquidityGrossAfter = LiquidityMath.addDelta(liquidityGrossBefore, liquidityDelta);

require(liquidityGrossAfter <= maxLiquidity, 'LO');

flipped = (liquidityGrossAfter == 0) != (liquidityGrossBefore == 0);如果tick从无流动性到有流动性,或者从有流动性变成无流动性,则表示tick需要翻转flipped。

if (liquidityGrossBefore == 0) {

// by convention, we assume that all growth before a tick was initialized happened _below_ the tick

if (tick <= tickCurrent) {

info.feeGrowthOutside0X128 = feeGrowthGlobal0X128;

info.feeGrowthOutside1X128 = feeGrowthGlobal1X128;

info.secondsPerLiquidityOutsideX128 = secondsPerLiquidityCumulativeX128;

info.tickCumulativeOutside = tickCumulative;

info.secondsOutside = time;

}

info.initialized = true;

}如果tick之前没有流动性,则进行初始化;对于小于当前tickCurrent的tick,设置Outside等变量。

info.liquidityGross = liquidityGrossAfter;liquidityGross表示总流动性,用于判断tick是否需要初始化:

- 如果

mint,则增加流动性;如果burn,则减少流动性 - 该变量与

tick在不同头寸中是否作为边界低点或高点无关,只与mint或burn操作有关 - 如果一个

tick同时被用作tickLower和tickUpper,则其liquidityNet可能是0,但liquidityGross仍然会大于0,因此不需要再次初始化

// when the lower (upper) tick is crossed left to right (right to left), liquidity must be added (removed)

info.liquidityNet = upper

? int256(info.liquidityNet).sub(liquidityDelta).toInt128()

: int256(info.liquidityNet).add(liquidityDelta).toInt128();

}liquidityNet表示净流动性,当swap穿越tick时,用于更新全局可用流动性liquidity:

- 如果作为

tickLower,即边界低点(左边界点),则增加liquidityDelta(mint时为正,burn时为负) - 如果作为

tickUpper,即边界高点(右边界点),则减少liquidityDelta(mint时为正,burn时为负)

clear

当tick翻转后,如果没有流动性关联该tick,即liquidityGross = 0,则清空tick状态:

/// @notice Clears tick data

/// @param self The mapping containing all initialized tick information for initialized ticks

/// @param tick The tick that will be cleared

function clear(mapping(int24 => Tick.Info) storage self, int24 tick) internal {

delete self[tick];

}cross

当tick被穿越时,需要翻转Outside等变量的方向,如白皮书公式6.20:

$$ f_o(i) := f_g - f_o(i) \quad \text{(6.20)} $$

这些变量在getFeeGrowthInside等方法被用到。

/// @notice Transitions to next tick as needed by price movement

/// @param self The mapping containing all tick information for initialized ticks

/// @param tick The destination tick of the transition

/// @param feeGrowthGlobal0X128 The all-time global fee growth, per unit of liquidity, in token0

/// @param feeGrowthGlobal1X128 The all-time global fee growth, per unit of liquidity, in token1

/// @param secondsPerLiquidityCumulativeX128 The current seconds per liquidity

/// @param tickCumulative The tick * time elapsed since the pool was first initialized

/// @param time The current block.timestamp

/// @return liquidityNet The amount of liquidity added (subtracted) when tick is crossed from left to right (right to left)

function cross(

mapping(int24 => Tick.Info) storage self,

int24 tick,

uint256 feeGrowthGlobal0X128,

uint256 feeGrowthGlobal1X128,

uint160 secondsPerLiquidityCumulativeX128,

int56 tickCumulative,

uint32 time

) internal returns (int128 liquidityNet) {

Tick.Info storage info = self[tick];

info.feeGrowthOutside0X128 = feeGrowthGlobal0X128 - info.feeGrowthOutside0X128;

info.feeGrowthOutside1X128 = feeGrowthGlobal1X128 - info.feeGrowthOutside1X128;

info.secondsPerLiquidityOutsideX128 = secondsPerLiquidityCumulativeX128 - info.secondsPerLiquidityOutsideX128;

info.tickCumulativeOutside = tickCumulative - info.tickCumulativeOutside;

info.secondsOutside = time - info.secondsOutside;

liquidityNet = info.liquidityNet;

}TickMath.sol

TickMath主要包含两个方法:

- getSqrtRatioAtTick:根据tick计算开根号价格 $\sqrt{P}$

- getTickAtSqrtRatio:根据开根号价格 $\sqrt{P}$ 计算tick

getSqrtRatioAtTick

该方法对应白皮书公式6.2:

$$ \sqrt{p}(i) = \sqrt{1.0001}^i = 1.0001^{\frac{i}{2}} $$

其中, $i$ 即为tick。

因为Uniswap v3支持的价格( $\frac{token1}{token0}$ )区间为 $[2^{-128}, 2^{128}]$ ,根据白皮书公式6.1:

$$ p(i) = 1.0001^i $$

因此,对应的最大tick(MAX_TICK)为:

$$ i = \lfloor log{1.0001}{p(i)} \rfloor = \lfloor log{1.0001}{2^{128}} \rfloor = \lfloor 887272.7517970635 \rfloor = 887272 $$

最小tick(MIN_TICK)为:

$$ i = \lceil log_{1.0001}{2^{-128}} \rceil = \lceil -887272.7517970635 \rceil = -887272 $$

假设 $i$ $\geq 0$,对于一个给定的tick $i$,它总可以表示为二进制,因此以下式子总是成立:

$$ \begin{cases} i = \sum_{n=0}^{19}{(x_n \cdot 2^n)} = x_0 \cdot 1 + x_1 \cdot 2 + x2 \cdot 4 + ... + x{19}\cdot 524288 \ \forall x_n \in {0, 1} \end{cases} \quad \text{(1.1)} $$

其中, $x_n$ 为 $i$ 的二进制位。如 $i=6$ ,其对应的二进制为:000000000000000000000110,则 $x_1 = 1, x_2 = 1$ ,其余 $x_n$ 均为0。

同样可以推出 $i < 0$ 也可以用类似的公式表示。

我们先看 $i < 0$ 的情况:

如果 $i < 0$,则:

$$ \sqrt{p}(i) = 1.0001^{\frac{i}{2}} = 1.0001^{-\frac{|i|}{2}} = \frac{1}{1.0001^{\frac{|i|}{2}}} = \frac{1}{1.0001^{\frac{1}{2}(\sum_{n=0}^{19}{(x_n \cdot 2^n)})}} \ = \frac{1}{1.0001^{\frac{1}{2} \cdot x_0}} \cdot \frac{1}{1.0001^{\frac{2}{2} \cdot x_1}} \cdot \frac{1}{1.0001^{\frac{4}{2} \cdot x2}} \cdot ... \cdot \frac{1}{1.0001^{\frac{524288}{2} \cdot x{19}}} $$

根据二进制位 $x_n$ 的值,可以总结如下:

$$ \frac{1}{1.0001^{\frac{x_n \cdot 2^n}{2}}} \begin{cases} = 1 & \text{$x_n = 0, n \geq 0, i < 0$}\ < 1 & \text{$x_n = 1, n \geq 0, i < 0$} \end{cases} $$

为了最小化精度误差,在计算过程中,使用Q128.128(128位定点数)表示中间价格,对于每一个价格 $p$ ,均需要左移128位。由于 $i < 0, x_n = 1$ 时, $\frac{1}{1.0001^{\frac{x_n \cdot 2^n}{2}}} < 1$ ,因此在连续乘积过程中不会有溢出问题。

可以总结计算 $\sqrt{p}(i)$ 的方法:

- 初始值为1,从第0位开始,从低位到高位(从右往左)循环遍历 $i$ 的二进制比特位

- 如果该位不为0,则乘以对应的 $\frac{2^{128}}{1.0001^{\frac{2^n}{2}}}$ ,其中 $2^{128}$ 表示左移128位

- 如果该位为0,则乘以1,可以省略

/// @notice Calculates sqrt(1.0001^tick) * 2^96

/// @dev Throws if |tick| > max tick

/// @param tick The input tick for the above formula

/// @return sqrtPriceX96 A Fixed point Q64.96 number representing the sqrt of the ratio of the two assets (token1/token0)

/// at the given tick

function getSqrtRatioAtTick(int24 tick) internal pure returns (uint160 sqrtPriceX96) {

uint256 absTick = tick < 0 ? uint256(-int256(tick)) : uint256(int256(tick));

require(absTick <= uint256(MAX_TICK), 'T');

// 如果第0位非0,则ratio = 0xfffcb933bd6fad37aa2d162d1a594001 ,即:2^128 / 1.0001^0.5

uint256 ratio = absTick & 0x1 != 0 ? 0xfffcb933bd6fad37aa2d162d1a594001 : 0x100000000000000000000000000000000;

// 如果第1位非0,则乘以 0xfff97272373d413259a46990580e213a ,即:2^128 / 1.0001^1,因为两个乘数均为Q128.128,最终结果多乘了2^128,因此需要右移128

if (absTick & 0x2 != 0) ratio = (ratio * 0xfff97272373d413259a46990580e213a) >> 128;

// 如果第2位非0,则乘以 0xfff2e50f5f656932ef12357cf3c7fdcc ,即:2^128 / 1.0001^2,

if (absTick & 0x4 != 0) ratio = (ratio * 0xfff2e50f5f656932ef12357cf3c7fdcc) >> 128;

// 以此类推

if (absTick & 0x8 != 0) ratio = (ratio * 0xffe5caca7e10e4e61c3624eaa0941cd0) >> 128;

if (absTick & 0x10 != 0) ratio = (ratio * 0xffcb9843d60f6159c9db58835c926644) >> 128;

if (absTick & 0x20 != 0) ratio = (ratio * 0xff973b41fa98c081472e6896dfb254c0) >> 128;

if (absTick & 0x40 != 0) ratio = (ratio * 0xff2ea16466c96a3843ec78b326b52861) >> 128;

if (absTick & 0x80 != 0) ratio = (ratio * 0xfe5dee046a99a2a811c461f1969c3053) >> 128;

if (absTick & 0x100 != 0) ratio = (ratio * 0xfcbe86c7900a88aedcffc83b479aa3a4) >> 128;

if (absTick & 0x200 != 0) ratio = (ratio * 0xf987a7253ac413176f2b074cf7815e54) >> 128;

if (absTick & 0x400 != 0) ratio = (ratio * 0xf3392b0822b70005940c7a398e4b70f3) >> 128;

if (absTick & 0x800 != 0) ratio = (ratio * 0xe7159475a2c29b7443b29c7fa6e889d9) >> 128;

if (absTick & 0x1000 != 0) ratio = (ratio * 0xd097f3bdfd2022b8845ad8f792aa5825) >> 128;

if (absTick & 0x2000 != 0) ratio = (ratio * 0xa9f746462d870fdf8a65dc1f90e061e5) >> 128;

if (absTick & 0x4000 != 0) ratio = (ratio * 0x70d869a156d2a1b890bb3df62baf32f7) >> 128;

if (absTick & 0x8000 != 0) ratio = (ratio * 0x31be135f97d08fd981231505542fcfa6) >> 128;

if (absTick & 0x10000 != 0) ratio = (ratio * 0x9aa508b5b7a84e1c677de54f3e99bc9) >> 128;

if (absTick & 0x20000 != 0) ratio = (ratio * 0x5d6af8dedb81196699c329225ee604) >> 128;

if (absTick & 0x40000 != 0) ratio = (ratio * 0x2216e584f5fa1ea926041bedfe98) >> 128;

// 如果第19位非0,因为(2^19 = 0x80000=524288),则乘以 0x2216e584f5fa1ea926041bedfe98,即:2^128 / 1.0001^(524288/2)

// tick的最大值为887272,因此其二进制最多只需要20位表示,从0开始计数,最后一位为第19位。

if (absTick & 0x80000 != 0) ratio = (ratio * 0x48a170391f7dc42444e8fa2) >> 128;

if (tick > 0) ratio = type(uint256).max / ratio;

// this divides by 1<<32 rounding up to go from a Q128.128 to a Q128.96.

// we then downcast because we know the result always fits within 160 bits due to our tick input constraint

// we round up in the division so getTickAtSqrtRatio of the output price is always consistent

sqrtPriceX96 = uint160((ratio >> 32) + (ratio % (1 << 32) == 0 ? 0 : 1));

}假设 $i > 0$ 时:

$$ \sqrt{p{Q128128}(i)} = 2^{128} \cdot \sqrt{p(i)} = 2^{128} \cdot 1.0001^{\frac{i}{2}} \ = \frac{2^{128}}{1.0001^{-\frac{i}{2}}} = \frac{2^{256}}{2^{128} \cdot \sqrt{p(-i)}} = \frac{2^{256}}{\sqrt{p{Q128128}(-i)}} $$

因此,只需要算出 $i < 0$ 时的 ratio 值,使用 $2^{256}$ 除以ratio即可得出 $i > 0$ 时,使用Q128.128表示的ratio值:

if (tick > 0) ratio = type(uint256).max / ratio;代码最后一行将ratio右移32位,转化为Q128.96格式的定点数:

sqrtPriceX96 = uint160((ratio >> 32) + (ratio % (1 << 32) == 0 ? 0 : 1));这里算的是开根号价格 $\sqrt{p}$ ,由于价格 $p$ 最大为 $2^{128}$ ,因此 $\sqrt{p}$ 最大为 $2^{64}$ ,也就是整数部分最大只需要64位表示,因此最终的sqrtPriceX96一定可以用160位(64+96,即Q64.96格式的定点数)表示。

getTickAtSqrtRatio

该方法对应白皮书中的公式6.8:

$$ ic = \lfloor \log{\sqrt{1.0001}} \sqrt{P} \rfloor $$

本方法涉及在Solidity中计算对数,根据对数公式,可以推出:

$$ \log_{\sqrt{1.0001}} \sqrt{P} = \frac{log_2{\sqrt{P}}}{log_2{\sqrt{1.0001}}} = log2{\sqrt{P}} \cdot log{\sqrt{1.0001}}{2} $$

由于 $log_{\sqrt{1.0001}}{2}$ 是一个常数,因此我们只需要计算 $log_2{\sqrt{P}}$ 即可。

将输入的参数为 $\sqrt{P}$ 看作 $x$ ,问题转化为求 $log_2{x}$。

把结果分为整数部分 $n$ 和小数部分 $m$ ,则:

$$ n \leq log_2{x} = n + m < n + 1 $$

整数部分

对于 $n$ ,因为:

$$ 2^n \leq x < 2^{n+1} $$

可以通过二分查找找到 $n$ 值:

- 对于256位的数, $0 \leq n < 256$ ,可以用8位比特表示 $n$

- 从二进制表示的第8位(k=7)到第1位(k=0)(从最高位到最低位),依次比较 $x$ 是否大于 $2^{2^{k}} - 1$ ,如果大于则标记该位为1,并右移 $2^k$ 位;否则标记0

- 最终标记后的8位二进制即为 $n$ 值

使用Python代码描述如下:

def find_msb(x):

msb = 0

for k in reversed(range(8)): // k = 7, 6, 5. 4, 3, 2, 1, 0

if x > 2 ** (2 ** k) - 1:

msb += 2 ** k // 标记该位为1,即加上 2 ** k

x /= 2 ** (2 ** k) // 右移 2 ** k 位

return msbUniswap v3中的Solidity代码如下(请参考代码中注释):

/// @notice Calculates the greatest tick value such that getRatioAtTick(tick) <= ratio

/// @dev Throws in case sqrtPriceX96 < MIN_SQRT_RATIO, as MIN_SQRT_RATIO is the lowest value getRatioAtTick may

/// ever return.

/// @param sqrtPriceX96 The sqrt ratio for which to compute the tick as a Q64.96

/// @return tick The greatest tick for which the ratio is less than or equal to the input ratio

function getTickAtSqrtRatio(uint160 sqrtPriceX96) internal pure returns (int24 tick) {

// second inequality must be < because the price can never reach the price at the max tick

require(sqrtPriceX96 >= MIN_SQRT_RATIO && sqrtPriceX96 < MAX_SQRT_RATIO, 'R');

uint256 ratio = uint256(sqrtPriceX96) << 32; // 左移32位,转化为Q128.128格式

uint256 r = ratio;

uint256 msb = 0;

assembly {

// 如果大于2 ** (2 ** 7) - 1,则保存临时变量:2 ** 7

let f := shl(7, gt(r, 0xFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFFF))

// msb += 2 ** 7

msb := or(msb, f)

// r /= (2 ** (2 ** 7)),即右移 2 ** 7

r := shr(f, r)

}

assembly {

let f := shl(6, gt(r, 0xFFFFFFFFFFFFFFFF))

msb := or(msb, f)

r := shr(f, r)

}

assembly {

let f := shl(5, gt(r, 0xFFFFFFFF))

msb := or(msb, f)

r := shr(f, r)

}

assembly {

let f := shl(4, gt(r, 0xFFFF))

msb := or(msb, f)

r := shr(f, r)

}

assembly {

let f := shl(3, gt(r, 0xFF))

msb := or(msb, f)

r := shr(f, r)

}

assembly {

let f := shl(2, gt(r, 0xF))

msb := or(msb, f)

r := shr(f, r)

}

assembly {

let f := shl(1, gt(r, 0x3))

msb := or(msb, f)

r := shr(f, r)

}

assembly {

let f := gt(r, 0x1)

msb := or(msb, f)

}小数部分

对于小数部分 $m$:

$$ 0 \leq m = log_2{x} - n = log_2{\frac{x}{2^n}} < 1 \quad \text{(1.2)} $$

其中, $n$ 为上文算出的msb,即整数部分。

我们先将 $\frac{x}{2^n}$ 看做一个整体 $r$,则:

$$ 0 \leq log_2{r} < 1 $$

$$ 1 \leq r = \frac{x}{2^n} < 2 $$

这里我们希望求出 $log_2{r}$ ,如果能够将 $log_2{r}$ 表示成一个不断收敛的数列,当小数位足够多时,就可以近似求出 $log_2{r}$ 的值。

根据对数公式,我们可以推导以下两个等式:

$$ log_2{r} = \frac{2 \cdot log_2{r}}{2} = \frac{log_2{r^2}}{2} \quad \text{(1.3)} $$

$$ log_2{r} = log_2{2 \cdot \frac{r}{2}} = 1 + log_2{\frac{r}{2}} \quad \text{(1.4)} $$

我们循环套用上述两个公式,可以整理以下方法:

- 因为初始时 $log_2{r} < 1$,因此先应用公式1.3,将问题转化为求 $log_2{r^2}$ ,注意此时基数为 $\frac{1}{2}$ ;

- 事实上,每一次进入步骤1,新的基数都是上一次基数的 $\frac{1}{2}$ ,比如第二次进入步骤1的基数为 $\frac{1}{4}$ ,以此类推。

- 如果 $r^2$ >= 2 ,则应用公式1.4,分离出1,并将问题转化为求 $log_2{\frac{r^2}{2}}$ ;

- 因为公式1.4是在公式1.3之后判断,因此这里的1需要乘以上一次步骤1的基数,如果是第一次则记录 $\frac{1}{2}$ ,第二次则记录 $\frac{1}{4}$ ,以此类推;

- 因为 $1 \leq r < 2$ ,且 $2 \leq r^2 < 4$ ,因此 $1 \leq \frac{r^2}{2} < 2$ ,将 $\frac{r^2}{2}$ 看做一个整体 $r$ ,又回到步骤1求解 $log_2{r}$ ,并且 $1 \leq r < 2$ 。

- 如果 $r^2 < 2$ ,则回到步骤1继续。

可以将上述步骤总结为以下公式:

$$ log_2{r} = m_1 \cdot \frac{1}{2} + m_2 \cdot \frac{1}{4} + ... + mn \cdot \frac{1}{2^n} = \sum^{\infty}{i=1}(m_i \cdot \frac{1}{2^i}) \quad \text{(1.5)} $$

其中, $\forall m_i \in {0, 1}$。

这其实就是小数的二进制表示法,小数的二进制第一位表示为 $2^{-1}$ ,第二位为 $2^{-2}$ ,以此类推。而在我们上述计算 $log_2{r}$ 的步骤中,如果进入步骤2,则相当于标记该位为1;如果进入步骤3,则相当于标记该位为0。

重复以上步骤的过程,即为确认小数部分二进制位从高位到低位(从左到右)每一位的值,每一个循环确认一位。循环次数越多,计算得出的 $log_2{r}$ 精度越高。

我们继续看 Uniswap v3 中计算小数部分的代码:

if (msb >= 128) r = ratio >> (msb - 127);

else r = ratio << (127 - msb);这里msb即为整数部分 $n$ 。因为ratio是Q128.128,如果msb >= 128则表示ratio >= 1,因此需要右移整数位数得到小数部分ratio >> msb;-127表示左移127位,使用Q129.127表示小数部分;同样,如果msb < 128,则表示ratio < 1,其本身就只有小数部分,因此通过左移127 - msb位,将小数部分凑齐127位,也用Q129.127表示小数部分。

实际上,ratio >> msb即为公式1.2中的 $\frac{x}{2^n}$ ,也就是步骤1中的 $r$ ,在后续迭代算法(步骤1-3)中需要用到。

int256 log_2 = (int256(msb) - 128) << 64;因为msb是基于Q128.128的ratio计算的,int256(msb) - 128表示 $n$ 的真正值。<< 64使用Q192.64表示 $n$ 。

这一行代码实际上是使用Q192.64保存整数部分的值。

下面代码循环计算二进制表示的小数部分的前14位小数:

assembly {

// 根据步骤1,计算r^2,右移127位是因为两个r都是Q129.127

r := shr(127, mul(r, r))

// 因为1 <= r^2 < 4,仅需2位表示r^2的整数,

// 因此从右往左数第129和128位表示r^2的整数部分,

// 右移128位,仅剩129位,

// 该值为1,则表示r >= 2;该值为0,则表示r < 2

let f := shr(128, r)

// 如果f == 1,则log_2 += Q192.64的1/2

log_2 := or(log_2, shl(63, f))

// 根据步骤2(即公式1.4),如果r >= 2(即f == 1),则r /= 2;否则不操作,即步骤3

r := shr(f, r)

}

// 重复进行上述过程

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(62, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(61, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(60, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(59, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(58, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(57, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(56, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(55, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(54, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(53, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(52, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(51, f))

r := shr(f, r)

}

assembly {

r := shr(127, mul(r, r))

let f := shr(128, r)

log_2 := or(log_2, shl(50, f))

}上述计算的log_2即为Q192.64表示的 $log_2{\sqrt{P}}$ ,精度为 $2^{-14}$ 。

int256 log_sqrt10001 = log_2 * 255738958999603826347141; // 128.128 number因为:

$$ \log_{\sqrt{1.0001}} \sqrt{P} = \frac{log_2{\sqrt{P}}}{log_2{\sqrt{1.0001}}} = log2{\sqrt{P}} \cdot log{\sqrt{1.0001}}{2} $$

这里255738958999603826347141即为 $log_{\sqrt{1.0001}}{2} \cdot 2^{64}$ ,两个Q192.64乘以的结果为Q128.64(不会发生溢出)。

由于这里算出的 $log_2{\sqrt{P}}$ 精度为 $2^{-14}$ ,乘以255738958999603826347141后误差进一步放大,因此需要修正并确保结果是最接近给定价格的tick。

int24 tickLow = int24((log_sqrt10001 - 3402992956809132418596140100660247210) >> 128);

int24 tickHi = int24((log_sqrt10001 + 291339464771989622907027621153398088495) >> 128);

tick = tickLow == tickHi ? tickLow : getSqrtRatioAtTick(tickHi) <= sqrtPriceX96 ? tickHi : tickLow;其中,3402992956809132418596140100660247210表示0.01000049749154292 << 128,291339464771989622907027621153398088495表示0.8561697375276566 << 128。

参考abdk的这篇文章,当精度为 $2^{-14}$ 时,tick的最小误差为 $− 0.85617$ ,最大误差为 $0.0100005$ 。同时,这篇文章也从理论上证明了,只有当精度等于(或高于) $2^{-14}$ 时,只需要一次计算即可得出所需的tick值。

我们的目的是寻找满足当前条件的最大tick,使得tick对应的 $\sqrt{P}$ 小于等于传入的值。因此如果补偿后的tickHi满足要求,则优先使用tickHi;否则使用tickLow。

以下是本节参考文章,有兴趣的朋友请扩展阅读:

TickBitmap.sol

TickBitmap使用Bitmap(位图)保存Tick的初始化状态,提供以下几个方法:

- position:根据tick返回位图索引数据

- flipTick:翻转tick状态

- nextInitializedTickWithinOneWord:寻找同组内下一个初始化的tick

position

/// @notice Computes the position in the mapping where the initialized bit for a tick lives

/// @param tick The tick for which to compute the position

/// @return wordPos The key in the mapping containing the word in which the bit is stored

/// @return bitPos The bit position in the word where the flag is stored

function position(int24 tick) private pure returns (int16 wordPos, uint8 bitPos) {

wordPos = int16(tick >> 8);

bitPos = uint8(tick % 256);

}只有能被tickSpacing整除的tick才能记录在位图中,因此此处的参数: $tick = \frac{tick}{tickSpacing}$。

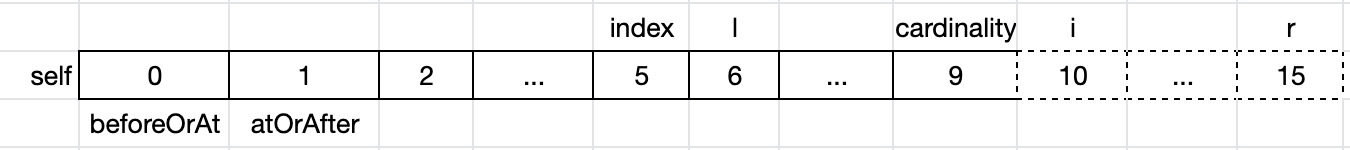

tick类型为int24,其二进制从右到左,从低位到高位,前8位表示bitPos,后16位表示wordPos,如下图所示:

$$ \overbrace{23,...,8}^{wordPos},\overbrace{7,...,0}^{bitPos} $$

tick的bitmap表示为:self[wordPos] ^= 1 << bitPos。

flipTick

当tick翻转初始化状态时,如果其位图的值为0,则需要修改为1;否则,修改为0;即对该位“取反”。

/// @notice Flips the initialized state for a given tick from false to true, or vice versa

/// @param self The mapping in which to flip the tick

/// @param tick The tick to flip

/// @param tickSpacing The spacing between usable ticks

function flipTick(

mapping(int16 => uint256) storage self,

int24 tick,

int24 tickSpacing

) internal {

require(tick % tickSpacing == 0); // ensure that the tick is spaced

(int16 wordPos, uint8 bitPos) = position(tick / tickSpacing);

uint256 mask = 1 << bitPos;

self[wordPos] ^= mask;

}首先获取tick对应的wordPos和bitPos,由于最后针对bitPos执行按位“异或”操作:

因为1与任何值b(0或1)异或等于~b;0与任何值b(0或1)异或等于b。

- 对于

tick对应的位(bit),mask为1- 如果旧值为1,

1^1=0,因此tick状态由“初始化”变成“未初始化”; - 如果旧值为0,

0^1=1,因此tick状态由“未初始化”变成“初始化”

- 如果旧值为1,

- 对于非

tick对应的位,mask为0- 如果旧值为1,

1^0=1,因此状态不变 - 如果旧值为0,

0^0=0,因此状态不变

- 如果旧值为1,

所以,上述代码实现了tick位取反的效果。

nextInitializedTickWithinOneWord

根据参数tick,寻找位图上最近一个已初始化的tick,如未找到,返回本组最后一个未初始化的tick。

/// @notice Returns the next initialized tick contained in the same word (or adjacent word) as the tick that is either

/// to the left (less than or equal to) or right (greater than) of the given tick

/// @param self The mapping in which to compute the next initialized tick

/// @param tick The starting tick

/// @param tickSpacing The spacing between usable ticks

/// @param lte Whether to search for the next initialized tick to the left (less than or equal to the starting tick)

/// @return next The next initialized or uninitialized tick up to 256 ticks away from the current tick

/// @return initialized Whether the next tick is initialized, as the function only searches within up to 256 ticks

function nextInitializedTickWithinOneWord(

mapping(int16 => uint256) storage self,

int24 tick,

int24 tickSpacing,

bool lte

) internal view returns (int24 next, bool initialized) {

int24 compressed = tick / tickSpacing;

if (tick < 0 && tick % tickSpacing != 0) compressed--; // round towards negative infinity

if (lte) {

(int16 wordPos, uint8 bitPos) = position(compressed);

// all the 1s at or to the right of the current bitPos

uint256 mask = (1 << bitPos) - 1 + (1 << bitPos);

uint256 masked = self[wordPos] & mask;

// if there are no initialized ticks to the right of or at the current tick, return rightmost in the word

initialized = masked != 0;

// overflow/underflow is possible, but prevented externally by limiting both tickSpacing and tick

next = initialized

? (compressed - int24(bitPos - BitMath.mostSignificantBit(masked))) * tickSpacing

: (compressed - int24(bitPos)) * tickSpacing;

} else {

// start from the word of the next tick, since the current tick state doesn't matter

(int16 wordPos, uint8 bitPos) = position(compressed + 1);

// all the 1s at or to the left of the bitPos

uint256 mask = ~((1 << bitPos) - 1);

uint256 masked = self[wordPos] & mask;

// if there are no initialized ticks to the left of the current tick, return leftmost in the word

initialized = masked != 0;

// overflow/underflow is possible, but prevented externally by limiting both tickSpacing and tick

next = initialized

? (compressed + 1 + int24(BitMath.leastSignificantBit(masked) - bitPos)) * tickSpacing

: (compressed + 1 + int24(type(uint8).max - bitPos)) * tickSpacing;

}

}如果lte == true,即寻找小于等于当前tick的值,因此问题转化为:寻找低比特位上是否有1。

if (lte) {

(int16 wordPos, uint8 bitPos) = position(compressed);

// all the 1s at or to the right of the current bitPos

uint256 mask = (1 << bitPos) - 1 + (1 << bitPos);

uint256 masked = self[wordPos] & mask;

}其中,mask的值为所有小于等于bitPos的位全部置1,比如bitPos = 7,则mask二进制 = 1111111;masked保留位图中小于等于bitPos的位值,比如self[wordPos] = 110101011,则masked = 110101011 & 1111111 = 000101011。

如果masked != 0,则表示当前方向(lte)该wordPos上有初始化的tick;否则,则表示该方向都是未初始化的tick。

// if there are no initialized ticks to the right of or at the current tick, return rightmost in the word

initialized = masked != 0;如果存在已初始化的tick,则需要定位到masked中最高位的1;如果不存在,则返回当前方向最后一个tick。

// overflow/underflow is possible, but prevented externally by limiting both tickSpacing and tick

next = initialized

? (compressed - int24(bitPos - BitMath.mostSignificantBit(masked))) * tickSpacing

: (compressed - int24(bitPos)) * tickSpacing;BitMath.mostSignificantBit(masked)通过二分查找法找到masked最高位的1,关于该算法的具体说明,可参考本文TickMath对数计算部分。简单而言,mostSignificantBit(masked)会返回一个数n,使得:

$$ 2^n \leq masked < 2^{n+1} $$

比如,如果masked = 000101011,mostSignificantBit将返回5,因为最高位的1在(从0开始)第5位:000101011。

compressed - int24(bitPos)表示当前wordPos第一个tick,compressed - int24(bitPos - BitMath.mostSignificantBit(masked))表示该最高位bitPos对应的tick;* tickSpacing将恢复到原始tick值,因为保存位图时,tick需要先除以tickSpacing。

同样,如果向大于当前tick方向寻找第一个已初始化的tick时,方法和上述类似,只是mostSignificantBit需要换成leastSignificantBit,即从tick比特位开始(不含),往高位寻找第一个bitPos位为1的tick。

else {

// start from the word of the next tick, since the current tick state doesn't matter

(int16 wordPos, uint8 bitPos) = position(compressed + 1);

// all the 1s at or to the left of the bitPos

uint256 mask = ~((1 << bitPos) - 1);

uint256 masked = self[wordPos] & mask;

// if there are no initialized ticks to the left of the current tick, return leftmost in the word

initialized = masked != 0;

// overflow/underflow is possible, but prevented externally by limiting both tickSpacing and tick

next = initialized

? (compressed + 1 + int24(BitMath.leastSignificantBit(masked) - bitPos)) * tickSpacing

: (compressed + 1 + int24(type(uint8).max - bitPos)) * tickSpacing;

}Position.sol

Position.sol管理头寸相关信息,包括以下方法:

一个头寸(Position)可由“所有者”owner、“区间低点”tickLower和“区间高点”tickUpper唯一确定,对于同一个交易对池子,每个用户可以创建多个不同价格区间的头寸,但只能创建一个相同价格区间的头寸;不同用户可以创建相同价格区间的头寸。

get

根据owner、tickLower和tickUpper返回一个头寸对象:

/// @notice Returns the Info struct of a position, given an owner and position boundaries

/// @param self The mapping containing all user positions

/// @param owner The address of the position owner

/// @param tickLower The lower tick boundary of the position

/// @param tickUpper The upper tick boundary of the position

/// @return position The position info struct of the given owners' position

function get(

mapping(bytes32 => Info) storage self,

address owner,

int24 tickLower,

int24 tickUpper

) internal view returns (Position.Info storage position) {

position = self[keccak256(abi.encodePacked(owner, tickLower, tickUpper))];

}update

更新头寸的流动性和可取回代币,注意,该方法只会在mint和burn时被触发,swap并不会更新头寸信息。

/// @notice Credits accumulated fees to a user's position

/// @param self The individual position to update

/// @param liquidityDelta The change in pool liquidity as a result of the position update

/// @param feeGrowthInside0X128 The all-time fee growth in token0, per unit of liquidity, inside the position's tick boundaries

/// @param feeGrowthInside1X128 The all-time fee growth in token1, per unit of liquidity, inside the position's tick boundaries

function update(

Info storage self,

int128 liquidityDelta,

uint256 feeGrowthInside0X128,

uint256 feeGrowthInside1X128

) internal {

Info memory _self = self;

uint128 liquidityNext;

if (liquidityDelta == 0) {

require(_self.liquidity > 0, 'NP'); // disallow pokes for 0 liquidity positions

liquidityNext = _self.liquidity;

} else {

liquidityNext = LiquidityMath.addDelta(_self.liquidity, liquidityDelta);

}更新流动性:

- 如果是

mint,则liquidityDelta > 0 - 如果是

burn,则liquidityDelta < 0

// calculate accumulated fees

uint128 tokensOwed0 =

uint128(

FullMath.mulDiv(

feeGrowthInside0X128 - _self.feeGrowthInside0LastX128,

_self.liquidity,

FixedPoint128.Q128

)

);

uint128 tokensOwed1 =

uint128(

FullMath.mulDiv(

feeGrowthInside1X128 - _self.feeGrowthInside1LastX128,

_self.liquidity,

FixedPoint128.Q128

)

);根据头寸区间自上一次更新后的每流动性手续费增长值,分别计算token0和token1的应收手续费。

// update the position

if (liquidityDelta != 0) self.liquidity = liquidityNext;

self.feeGrowthInside0LastX128 = feeGrowthInside0X128;

self.feeGrowthInside1LastX128 = feeGrowthInside1X128;

if (tokensOwed0 > 0 || tokensOwed1 > 0) {

// overflow is acceptable, have to withdraw before you hit type(uint128).max fees

self.tokensOwed0 += tokensOwed0;

self.tokensOwed1 += tokensOwed1;

}

}更新头寸流动性、本次每流动性手续费和可取回代币数。

SwapMath.sol

computeSwapStep

SwapMath只有一个方法,即computeSwapStep,计算单步交换的输入输出。

该方法实际上实现的是白皮书6.2.3小节:在一个Tick内交易。在该场景下,流动性 $L$ 不变,仅价格 $\sqrt{P}$ 发生变化。

参数如下:

sqrtRatioCurrentX96:当前价格sqrtRatioTargetX96:目标价格liquidity:可用流动性amountRemaining:剩余输入代币feePips:手续费

返回值:

sqrtRatioNextX96:交换后价格amountIn:本次交换消耗的输入代币amountOut:本次交换消耗的输出代币feeAmount:交易手续费(含协议手续费)

function computeSwapStep(

uint160 sqrtRatioCurrentX96,

uint160 sqrtRatioTargetX96,

uint128 liquidity,

int256 amountRemaining,

uint24 feePips

)

internal

pure

returns (

uint160 sqrtRatioNextX96,

uint256 amountIn,

uint256 amountOut,

uint256 feeAmount

)

{

bool zeroForOne = sqrtRatioCurrentX96 >= sqrtRatioTargetX96;

bool exactIn = amountRemaining >= 0;我们在swap章节提到,对于一个交换操作,根据zeroForOne和exactIn的值,有四种组合:

| zeroForOne | exactInput | swap |

|---|---|---|

| true | true | 输入固定数量token0,输出最大数量token1 |

| true | false | 输入最小数量token0,输出固定数量token1 |

| false | true | 输入固定数量token1,输出最大数量token0 |

| false | false | 输入最小数量token1,输出固定数量token0 |

if (exactIn) {

uint256 amountRemainingLessFee = FullMath.mulDiv(uint256(amountRemaining), 1e6 - feePips, 1e6);

amountIn = zeroForOne

? SqrtPriceMath.getAmount0Delta(sqrtRatioTargetX96, sqrtRatioCurrentX96, liquidity, true)

: SqrtPriceMath.getAmount1Delta(sqrtRatioCurrentX96, sqrtRatioTargetX96, liquidity, true);

if (amountRemainingLessFee >= amountIn) sqrtRatioNextX96 = sqrtRatioTargetX96;

else

sqrtRatioNextX96 = SqrtPriceMath.getNextSqrtPriceFromInput(

sqrtRatioCurrentX96,

liquidity,

amountRemainingLessFee,

zeroForOne

);

}如果是输入固定数量,则交易手续费需要从输入代币中扣除。

因为feePips的单位是百分之一基点,即 $\frac{1}{10^6}$ ,因此,按照如下公式扣除手续费:

$$ amountRemaining \cdot (1 - \frac{feePips}{10^6}) $$

使用getAmount0Delta或getAmount1Delta,根据当前价格、目标价格和可用流动性计算所需的输入代币数量amountIn:

- 如果从

token0交换token1,则输入代币为token0,因此计算amount0 - 如果从

token1交换token0,则输入代币为token1,因此计算amount1

注意,方法的最后一个参数roundUp,当计算amountIn时需要设置roundUp = true,也就是合约只能多收钱,而不能少收,否则合约资金将出现损失;同样,当计算amountOut时设置roundUp = false,也就是合约可以少付钱,而不能多付。

- 如果可用代币数量大于

amountIn,则表示该步交易可以完成,因此交换后的价格等于目标价格 - 否则,根据当前价格,可用流动性和可用代币

amountRemainingLessFee,计算交换后价格,我们在SqrtPriceMath.getNextSqrtPriceFromInput会具体介绍计算方法

else {

amountOut = zeroForOne

? SqrtPriceMath.getAmount1Delta(sqrtRatioTargetX96, sqrtRatioCurrentX96, liquidity, false)

: SqrtPriceMath.getAmount0Delta(sqrtRatioCurrentX96, sqrtRatioTargetX96, liquidity, false);

if (uint256(-amountRemaining) >= amountOut) sqrtRatioNextX96 = sqrtRatioTargetX96;

else

sqrtRatioNextX96 = SqrtPriceMath.getNextSqrtPriceFromOutput(

sqrtRatioCurrentX96,

liquidity,

uint256(-amountRemaining),

zeroForOne

);

}如果不是输入固定数量,也就是输出固定数量,需要将amountRemaining作为输出代币数量使用:

- 如果从

token0交换token1,则输出代币为token1,因此计算amount1 - 如果从

token1交换token0,则输出代币为token0,因此计算amount0

首先根据当前价格、目标价格和可用流动性,计算可产生的输出代币数量amountOut,注意,这里与上面相反,如果是token0交换token1,需要计算token1的数量,需使用SqrtPriceMath.getAmount1Delta方法。

当表示固定输出代币时,传入的参数amountRemaining是负值:

- 如果

amountOut的绝对值小于应输出代币数量,则表示可完全交换,交换后价格等于目标价格 - 否则,根据可用输出

amountRemaining,计算交换后价格

bool max = sqrtRatioTargetX96 == sqrtRatioNextX96;如果交换后价格等于目标价格,则表示完全交换。

// get the input/output amounts

if (zeroForOne) {

amountIn = max && exactIn

? amountIn

: SqrtPriceMath.getAmount0Delta(sqrtRatioNextX96, sqrtRatioCurrentX96, liquidity, true);

amountOut = max && !exactIn

? amountOut

: SqrtPriceMath.getAmount1Delta(sqrtRatioNextX96, sqrtRatioCurrentX96, liquidity, false);

} else {

amountIn = max && exactIn

? amountIn

: SqrtPriceMath.getAmount1Delta(sqrtRatioCurrentX96, sqrtRatioNextX96, liquidity, true);

amountOut = max && !exactIn

? amountOut

: SqrtPriceMath.getAmount0Delta(sqrtRatioCurrentX96, sqrtRatioNextX96, liquidity, false);

}计算本次交换所需输入amountIn和所得输出amountOut:

- 如果从

token0交换token1- 所需输入

amountIn- 如果完全交换,并且固定输入,则所需输入即为

amountIn - 否则(非完全交换,或者固定输出),则使用

getAmount0Delta,根据价格区间和流动性计算所需输入

- 如果完全交换,并且固定输入,则所需输入即为

- 所得输出

amountOut- 如果完全交换,并且固定输出,则所得输出即为

amountOut - 否则(非完全交换,或者固定输入),则使用

getAmount1Delta,根据价格区间和流动性计算所得输出

- 如果完全交换,并且固定输出,则所得输出即为

- 所需输入

- 如果从

token1交换token1- 所需输入

amountIn- 如果完全交换,并且固定输入,则所需输入即为

amountIn - 否则(非完全交换,或者固定输出),则使用

getAmount1Delta,根据价格区间和流动性计算所需输入

- 如果完全交换,并且固定输入,则所需输入即为

- 所得输出

amountOut- 如果完全交换,并且固定输出,则所得输出即为

amountOut - 否则(非完全交换,或者固定输入),则使用

getAmount0Delta,根据价格区间和流动性计算所得输出

- 如果完全交换,并且固定输出,则所得输出即为

- 所需输入

// cap the output amount to not exceed the remaining output amount

if (!exactIn && amountOut > uint256(-amountRemaining)) {

amountOut = uint256(-amountRemaining);

}确认所得输出没有超过指定输出。

if (exactIn && sqrtRatioNextX96 != sqrtRatioTargetX96) {

// we didn't reach the target, so take the remainder of the maximum input as fee

feeAmount = uint256(amountRemaining) - amountIn;

} else {

feeAmount = FullMath.mulDivRoundingUp(amountIn, feePips, 1e6 - feePips);

}计算交易手续费(包括协议手续费):

- 如果固定输入,并且没有达到目标价格,相当于是最后一次交换,则原始输入代币

amountRemaining扣除本次交换所需输入amountIn,即为手续费; - 否则,需要根据

amountIn计算手续费;注意,除了上述最后一次交换外,这里的amountIn和amountOut都是不包括手续费的,因此计算手续费需要除以1e6 - feePips,而非1e6。

SqrtPriceMath.sol

getNextSqrtPriceFromAmount0RoundingUp

根据当前价格、liquidity和 $\Delta{x}$ ,计算目标价格。

根据白皮书公式6.16:

$$ \Delta{x} = \Delta{\frac{1}{\sqrt{P}}} \cdot L $$

假设 $\sqrt{P_a} > \sqrt{P_b}$ ,则 $x_a < x_b$ :

$$ \Delta{x} = x_b - x_a $$

如果已知 $\sqrt{P_a}$ 计算 $\sqrt{P_b}$ ,则:

$$ \frac{1}{\sqrt{P_b}} = \frac{\Delta{x}}{L} + \frac{1}{\sqrt{P_a}} = \frac{1}{L} \cdot (\Delta{x} + \frac{L}{\sqrt{P_a}}) \quad \text{(1.1)} $$

$$ \sqrt{P_b} = \frac{L}{\Delta{x} + \frac{L}{\sqrt{P_a}}} \quad \text{(1.2)} $$

$$ {\sqrt{P_b}} = \frac{L \cdot \sqrt{P_a}}{L + \Delta{x} \cdot \sqrt{P_a}} \quad \text{(1.3)} $$

如果已知 $\sqrt{P_b}$ 计算 $\sqrt{P_a}$ ,则:

$$ \frac{1}{\sqrt{P_a}} = \frac{1}{\sqrt{P_b}} - \frac{\Delta{x}}{L} \quad \text{(1.4)} $$

$$ {\sqrt{P_a}} = \frac{L \cdot \sqrt{P_b}}{L - \Delta{x} \cdot \sqrt{P_b}} \quad \text{(1.5)} $$

/// @notice Gets the next sqrt price given a delta of token0

/// @dev Always rounds up, because in the exact output case (increasing price) we need to move the price at least

/// far enough to get the desired output amount, and in the exact input case (decreasing price) we need to move the

/// price less in order to not send too much output.

/// The most precise formula for this is liquidity * sqrtPX96 / (liquidity +- amount * sqrtPX96),

/// if this is impossible because of overflow, we calculate liquidity / (liquidity / sqrtPX96 +- amount).

/// @param sqrtPX96 The starting price, i.e. before accounting for the token0 delta

/// @param liquidity The amount of usable liquidity

/// @param amount How much of token0 to add or remove from virtual reserves

/// @param add Whether to add or remove the amount of token0

/// @return The price after adding or removing amount, depending on add

function getNextSqrtPriceFromAmount0RoundingUp(

uint160 sqrtPX96,

uint128 liquidity,

uint256 amount,

bool add